USGFX Review 2023

The rise of forex broking services in the forex market has opened doors for many forex brokers. Choosing one with reliable services and charges is a daunting task. This USGFX review will make your work easier by providing you an insight into the working of one of the popular forex brokers i.e., This broker along with its subsidiaries Union Standard International Group Pty Ltd (USG AU) and Union Standard International Group (USG UK).

Review of USGFX – Overview of Platform

Review of USGFX – Overview of PlatformAt the end of this review, a conclusion has been drawn as to whether it is a suitable forex broking firm for you or not after reviewing its features and the pros and cons. So, go through this review for a better understanding of the USGFX forex brokerage platform.

What Type of Forex Broker is USGFX?

It is an Australian forex broking company, affiliated with the Australian Securities & Investment Commission (ASIC). Union Standard International Group (USG UK) is also regulated by the Financial Conduct Authority (FCA) of the United Kingdom with FRN 798776. USG UK mainly deals in Forex and CFD trading solutions and helps clients achieve their investment objectives. The trading assistance is mainly for financial instruments like currency trading, indices, and commodities.

USG UK has a strong interbank connectivity, through the servers located in New York and London, for fast order execution. Union Standard International Group Ltd (USG UK) has a track record of great popularity for its research and educational tools and compliance to high trading standards which could be accessed through the Traders Club. These programs include seminars and webinars by a senior analyst and other expert advisors. Forex trades could be done by gathering all market related information at one place on a Traders Club platform with knowledge of proper standards and proper market tools.

The broker does not offer its services in countries like Japan, United States, North Korea etc. Recently, It obtained a license from the Financial Sector Conduct Authority (FSCA) of South Africa to offer its services in the country.

USGFX Reviews – Find more about it!

USGFX Reviews – Find more about it!Is USGFX Regulated?

Yes! Union Standard International Group Pty Ltd is regulated by the Australian Securities & Investment Commision (ASIC). Affiliation to ASIC makes sure that the brokers are following the regulation and guidelines of the statutory body.

In December 2019, ASIC received an interim asset restraining order from a Sydney court against BrightAU Capital Pty Ltd (trading name TradeFred) and Maxi EFX Global AU Pty Ltd (trading name EuropeFX). Both of these firms are Corporate Authorised Representatives of USGFX. (AFSL 302792).

The affiliation of Union Standard Group Pty Ltd to ASIC makes sure that the forex brokerage company has the transparency in its working. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Many retail investor accounts lose money when trading CFDs. Therefore, it may not be suitable for all investors. Carefully consider the high risk of trading such instruments as per your risk appetite

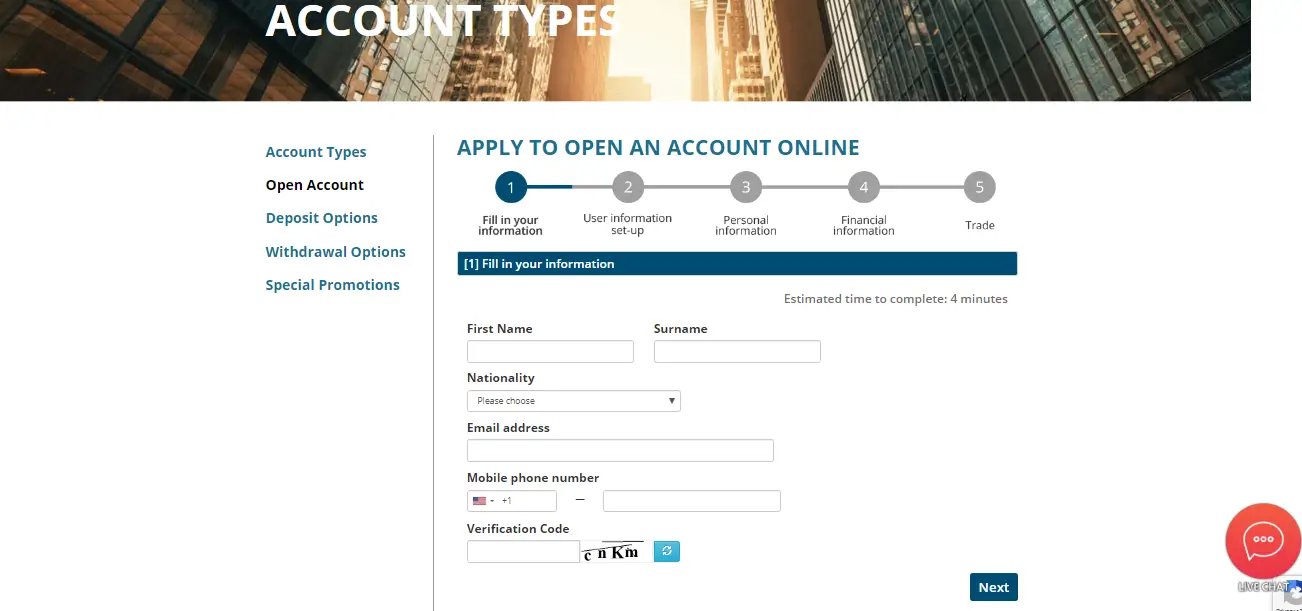

How to Open an Account With USGFX?

While opening an account with this broker, the following steps need to be followed-

Step 1: Registration: visit www.usgfx.com and click on the open account button. A separate page will open. In the first stage, you need to fill in the basic information, namely name, nationality, email address, contact number, and verification code.

Step 2: User Information set up: In the second step, account type, leverage rate, and meta trader version options are given. You also need to choose currency pairs and trading servers in the second step.

Step 3: Personal Information: This step requires you to provide more personal information like full address, occupation, etc.

Step 4: Financial Services Information: This step is like step 3 with more elaborate details on financial services information.

Step 5: Trade: After completing all the details, forex trades can be initiated. Before you start trading, you need to submit certain documents for operations of a different kind of account. The information about the documentation required has been provided on the official website (www.usgfx.com) of this broker.

What Are the Deposits and Withdrawals Methods?

USG UK has also kept its deposit and withdrawal options simple and convenient which are the same while mobile trading or trading via the desktop. Trading at USG UK include deposits and withdrawals as follows –

~ Deposit: There are a variety of options available to deposit funds in USGFX accounts in both web trading or mobile trading. Though the site advertises free deposit and withdrawal options it is available for certain platforms only. Deposits can be made through credit card, debit card, bank transfer, or third-party payment providers like China Union Pay.

For deposit, the following options could be used –

|

Deposit Options |

Instant deposit |

Instant to hours |

1 working days |

1-3 working days |

|

No deposit fees charged. |

Web Money, FASA pay, Thailand online banking, Malaysia online banking, Indonesia online banking, Vietnam online banking |

VISA USD Master card |

Perfect money. |

Bank wire transfer |

|

Deposit fees charged (condition applied ) |

Vogue pay and stick pay |

China union pay |

~ Withdrawal: Similarly, withdrawal requests are easy and smooth. There are many options available. These withdrawals are mainly fee-based with certain trading conditions applied.

|

Withdrawal options |

Withdrawal fees |

|

Bank wire transfer |

$25 |

|

Australian domestic |

No withdrawal fee |

|

VISA, master card, USD |

3.5% |

|

Web money, fast pay |

1.5% |

|

U pay |

1% |

|

Thailand online banking, Malaysian online banking |

1.7% |

|

Philippines online banking |

2% |

|

Vogue pay |

1.5% + 5 USD ( extra charge when the withdrawal is made with a credit card ) |

Minimum Deposit Requirements for USGFX Accounts

It requires a minimum deposit of $100 only to begin trading. Even with a minimum deposit, it allows access to the trading platform of the mini account. Spreads start from 2.8 pips. To trade in other accounts, a higher deposit amount is needed.

Demo Trading Account Options Available

USGFX offers a demo account option to its clients based on USGFX reviews. With the demo trading, option clients can get an understanding of the features of the platform before beginning the live trading. One thing to remember is that even for demo trading you need to deposit a minimum amount and open an account with this broker.

Forex Trading

In the context of initiating forex trades with this broker, its spread and swap rate depends upon the currency pairs chosen for trading. To access more spread it is advisable to visit the website and read through the market commentary. It states that it is based on a floating spread policy.

Floating spread policy states that rates are subjected to change in the market, with a special right with it to make changes in the rate. Also, there is no additional commission charged by the broker for forex trades, unless otherwise agreed. So using forex provides a transparent and decent service on its platform.

Risk disclaimer: CFDs are complex instruments, and Forex and CFDs trading carry a high level of risk of losing money. Many retail account holders lose money when trading CFDs. Therefore, it may not be suitable for all investors. Understand the high risk involved before investing.

USGFX Forex Trading

USGFX Forex TradingMetal Trading

Metal trading with USGFX depends upon the kind of account operated by the trader. The website states that there is no surplus commission to pay for metal trading.

Indices Trading

Indices trading has extra commission charges on and above the spread and swap. Though the spread price is based on the future price the broker has the discretion to control it. It is advisable to visit the website and get a proper understanding of the terms and conditions attached to the various trading options.

Does USGFX Have a Bonus?

Yes! The bonus options offered by this broker are:

|

Bonus |

Rate |

|

Bonus promotion |

50% |

|

Welcome Bonus |

10% |

|

Deposit Bonus |

25% |

|

Welcome Bonus |

$30 |

What Are the Different Kinds of Trading Accounts Available?

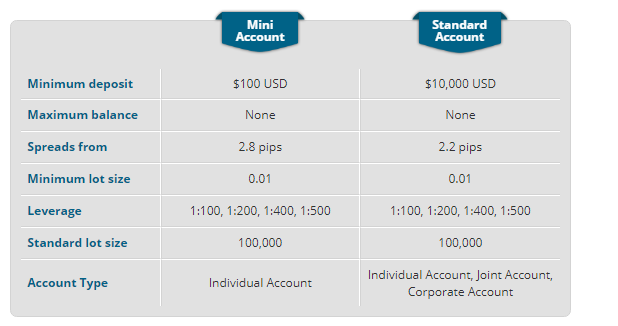

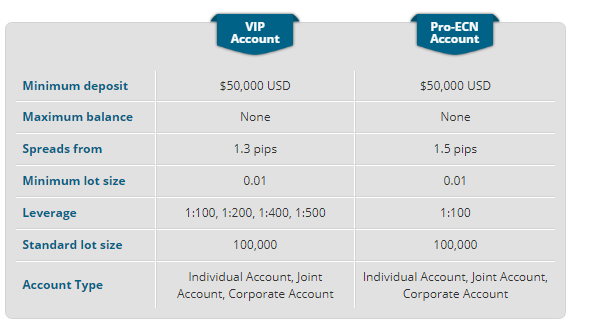

It provides four kinds of accounts to traders. These accounts have been designed in a manner that they are suitable for both beginners and advanced traders. The trading account you can open with multiple order types.

Review of USGFX – Account Types

Review of USGFX – Account Types~ Mini account for General: Trader can open this account with a minimum deposit of $100. Though the spreads are higher than the average more leverage is offered. Traders have the option to access leverage 1:100 up to 1:500.

~ USGFX Standard Account: The standard account has a large deposit required to activate. Investors can open this account for a deposit of $10,000. Leverages are the same as that of mini accounts with a larger spread, though. A user can open the standard account as a joint and corporate account.

~ Pro ECN for Professionals: USGFX pro ECN account could be open with a minimum deposit of $50,000. The ECN account leverage has been capped at 1:100, with a starting spread of 1.5 pips.

~ USGFX VIP Accounts: The VIP account has a minimum balance criteria of $50,000. The spread begins with 1.3 pips, and the leverage has been capped at 1:100.

USGFX Account Types

USGFX Account TypesIf users have any queries while setting up their account, they can get in touch with the customer service team via live chat support, email or phone available 24 hours. The customer support team is very prompt and supportive.

Key Features of USGFX

USGFX offers a variety of trading features to its users. Some of the unique trading features include social trading and global resource access. The main key features of this forex brokerage firm are–

~ Quick Withdrawals: It provides swift withdrawal services to its clients. All withdrawals could be processed within 24-48 hours. Clients need to provide their bank details, and a verification process has proceeded for authentication. Thereafter, the withdrawal amount is deposited in the client’s account.

~ Swift Execution: It is one of the fastest forex platforms available in the trading world. It is 12 times faster in execution with a capability of 10 fold latency reduction. It has a high latency reduction rate due to optical fiber connections with interbank servers of London and NewYork. This networking provides high-speed one-click trading to the investor using the trading platforms.

~ Negative Balance Protection: One of the key features provided by the platform is negative account balance protection. It operates with high trade confidentially and protects the negative account balance scenario though this option does not apply to DMA & CFD.

Review 2023 USGFX – Key Features

Review 2023 USGFX – Key Features~ Well Trained Account Manager: It has a highly dedicated account manager along with an account management team. The account management team assists the trader and provides requisite customer service via live chat, email or phone. The team offers different kinds of accounts to its customers. It provides a personal account manager to each trader, who offers 24/7 customer support.

~ Traders Club: It knows well that a transparent and rewarding trading experience is only possible when the trader will be knowledgeable. In its way to make clients educated about market proceedings in real time, current analysis, trading signals, this regulated broker has come up with a new project known as Traders Club.

Some of the key features of this Club are –

- Education program for traders of different levels

- Special trader education program for market analysis and risk management

- Regular seminars and content on market trading.

It also offers the unique option of social trading. It is exclusively designed for investors who are new to the market and do not have enough time to analyze the market and its market tools. All they have to do is to follow the social trend of the market through MyFxbook. Many insights and analysis from signal providers are available.

~ Reliable Trading Platform: It uses MetaTrader 4 & Metatrader5 trading apps. According to the USGFX broker reviews found in Forex Peace Army and TrustPilot, these are the latest trading platforms with high-end technology solutions. Both MT4, MT5 are highly sophisticated trading platforms, but MetaTrader 5 is the advanced version with more special features. These trading platforms could be operated on any device with an internet connection with access to the web trader. Access to web traders ensures connection to multi-terminal, which makes this platform swifter than others.

USGFX MetaTrader 4

USGFX MetaTrader 4~ Foreign Exchange Technical Analysis From Trading Central: It has a collaboration with Trading Central, which is one of the leading market research data providers. This collaboration with Trading Central helps USGFX in technical analysis of the foreign exchange market news. Trading Central gives this platform an added advantage over its competitors. Apart from that, it has an option for intraday trading through which users can enhance their trading skills.

~ Segregated Fund: This broker ensures security of the client’s funds. It has a segregated client account with the Commonwealth Bank of Australia for the client deposits.

Pros and Cons of USGFX Broker!

From the above key features, the following pros and cons could be drawn about this Broker

Pros

- Union Standard International Group Pty Ltd is ASIC approved

- MetaTrader 4 platform

- Access to web traders

- Multiple convenient withdrawal and deposit options

- Web portal available in multiple languages

Cons

- Higher advertise spread

- Stock Commodities not available

- Spread is higher than the average market

Conclusion

As per our review, It is a reliable forex broker which ensures an ideal trading environment. It is affiliated to ASIC and holds an Australian Financial Services Licence (AFSL). USG UK is also regulated by the Financial Conduct Authority (FCA) of the United Kingdom. The strict regulations of these regulatory bodies make sure that the client’s fund is protected and a secured transparent trading environment exists.

Our final verdict is that this broker is a good forex brokerage platform. On the drawback side, it has lesser trading tools than what is expected from a trading platform at this level. But you can benefit from the educational services of USG UK related to trading psychology and technical analysis. We can assure once you have tried the services of USG UK, you would never want to opt out.

FAQ’s

1. How USGFX operates?

Ans. It is a trading platform, which deals in forex, metal, indices, and commodities trading. It gives a smooth browsing experience. It charges commission and swap and spreads differences as its fees. In Union Standard International Group Pty Ltd, the trading costs for assets vary from one another.

2. Is USGFX regulated?

Ans. Yes! It is regulated by the Australian Securities and Investment Commission (ASIC) and holds an Australian Financial Services Licence (AFSL 302792) No one has had any complaints about its security features. Clients also enjoy insurance under the Financial Services Compensation Scheme (FSCS).

3. What is the maximum leverage I can get from USGFX?

Ans. Union Standard International Group (USG UK) offers leverage in between 1:200 to 1:500, as per user reviews. The maximum leverage it offers stands around 1:500.

4. Does it operate on MetaTrader?

Ans. Yes! It operates on both MT4 and MetaTrader 5. The features offered on both platforms are slightly different. It is more frequently operated on MT4.

5. Where are USGFX headquarters based?

Ans. Union Standard International Group Pty Ltd is an Australia based forex brokerage company headquartered in Sydney. It also has its satellite office in Hong Kong.