XM Vs Pepperstone

Background

XM Group is an online broker with expertise in forex (FX) and contracts for difference (CFDs) markets and innovative trading tools. Since 2009, XM Group has been serving traders with different levels of trading experience and has earned more than 3,500,000 satisfied clients. The broker is known for its thousands of assets, account types, minimum initial deposit, unmatched lower spreads, advanced trading platforms, and blazing fast order execution. Trading with XM Group is considered safe, for it is regulated by the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the International Financial Services Commission (IFSC) in Belize.

XM Forex Broker

XM Forex Broker

Risk Warning: 75.55% of retail investor accounts lose money when trading CFDs with this provider.

Established in 2010, Pepperstone is a progressive international online broker. With its modern technology and social copy trading function, Pepperstone is now one of the largest forex brokers in the world. The most popular features of this forex broker are cryptocurrency trading, the competitive electronic communication network (ECN), and commission fees. Pepperstone offers these extraordinary services under the supervision of the Australian Securities and Investments Commission (ASIC), the UK Financial Conduct Authority (FCA), the Dubai Financial Services Authority (DFSA), and the Securities Commission of the Bahamas (SCB).

Risk Warning: 79.3% of retail investor accounts lose money when trading CFDs with this provider.

60%-80% of retail investor accounts lose money when Trading CFDs because of over-leveraging their exposure to the markets. CFDs are complex instruments often offered through online platforms. You want to choose a broker that offers educational resources that will help you balance risk and reward. If you aren’t sure about whether to trade with XM Group or Pepperstone, this comparative guide will help you to make an informed choice.

XM Group Vs Pepperstone – Broker Reviews

| FEATURES | XM Group | Pepperstone |

| Regulations | ||

| ASIC (Australia) | ✔ | ✔ |

| BaFin (Germany) | ✔ | ✔ |

| CMA (Kenya) | ❌ | ✔ |

| CySEC (Cyprus) | ✔ | ✔ |

| DFSA (Dubai) | ✔ | ✔ |

| FCA (UK) | ✔ | ✔ |

| IFSC (Belize) | ✔ | ❌ |

| MiFID | ✔ | ✔ |

| SCB (Bahamas) | ✔ | ✔ |

| Financial Instruments | ||

| Agricultural | ❌ | ❌ |

| CFD | ✔ | ✔ |

| Commodities | ✔ | ✔ |

| Cryptocurrencies | With MT5 platform only | ✔ |

| Energy | ✔ | ✔ |

| ETFs | ❌ | ❌ |

| Forex (FX) | ✔ | ✔ |

| Indices | ✔ | ✔ |

| IPO | ✔ | ❌ |

| Precious Metals | ✔ | ✔ |

| Shares | ✔ | ✔ |

| Spot Fx | ✔ | ✔ |

| Spread Betting | ❌ | ✔ |

| Major Currency Pairs | ||

| AUD/USD | ✔ | ✔ |

| EUR/USD | ✔ | ✔ |

| GBP/USD | ✔ | ✔ |

| NZD/USD | ✔ | ✔ |

| USD/CAD | ✔ | ✔ |

| USD/CHF | ✔ | ✔ |

| USD/JPY | ✔ | ✔ |

| Trading Platforms | ||

| Automated Trading | ✔ | ✔ |

| cTrader | ❌ | ✔ |

| MetaTrader 4 (MT4) | ✔ | ✔ |

| MetaTrader 5 (MT5) | ✔ | ✔ |

| Mobile Trading | ✔ | ✔ |

| Proprietary Platform | ❌ | ❌ |

| Social Trading | ❌ | ✔ |

| Web Trader | ✔ | ✔ |

| Trading Accounts | ||

| Demo Account | ✔ | ✔ |

| ECN Account | ❌ | ✔ |

| Micro | ✔ | ❌ |

| Razor | ❌ | ✔ |

| Shares Account | ✔ | ❌ |

| Standard | ✔ | ✔ |

| Swap-Free/Islamic Account | ✔ | ✔ |

| Variable Spread Account | ✔ | ✔ |

| XM Group Ultra-Low Account | ✔ | ❌ |

| Zero Spread Account | ✔ | ❌ |

| Deposit and Withdrawal | ||

| Maximum Trade Size | 100 Lot | ❌ |

| Minimum Deposit | $5 | $200 |

| Minimum Trade Size | .01 Lot | .01 Lot |

| Minimum Withdrawal | ❌ | ❌ |

| Payment Methods | ||

| BPay | ❌ | ✔ |

| Credit/Debit Card | ✔ | ✔ |

| Neteller | ✔ | ✔ |

| PayPal | ❌ | ✔ |

| POLi | ❌ | ✔ |

| Skrill | ✔ | ✔ |

| Union Pay | ❌ | ✔ |

| Wire Transfer | ✔ | ✔ |

| Spreads/Commissions/Fees | ||

| Commission Fees | ✔ | ✔ |

| Deposit Fee | ❌ | ❌ |

| Fixed Spreads | ❌ | ❌ |

| Inactivity Fees | ✔ | ❌ |

| Overnight/Swap Fees | ✔ | ✔ |

| Variable Spreads | ✔ | ✔ |

| Withdrawal Fee | ❌ | ❌ |

| Risk Management Features | ||

| Direct Market Access | ❌ | ✔ |

| ECN Broker | ❌ | ✔ |

| Expert Advisors | ✔ | ✔ |

| Hedging | ✔ | ✔ |

| Limit Order | ✔ | ✔ |

| Market Maker | ✔ | ✔ |

| Maximum Leverage | Up to 888:1 (IFSC ) or 500:1 (ASIC) or 30:1 (FCA and CySEC) | Up to 500:1 (ASIC) or 50:1 (DFSA) or 30:1 (FCA and CySEC) |

| One-Click Trading | ✔ | ✔ |

| Price Alerts | ✔ | ✔ |

| Scalping | ✔ | ✔ |

| Segregates Clients Funds | ✔ | ✔ |

| Signal Trading | ✔ | ✔ |

| Stop Loss Order | ✔ | ✔ |

| STP Broker | ❌ | ✔ |

| Trailing Stops | ✔ | ✔ |

| Virtual Private Server | ✔ | ✔ |

| Zero Balance Protection | ✔ | ✔ |

| Trading Tools | ||

| Education | Webinars, Podcasts, Tutorial videos | Webinars, Blogs, Tutorial Videos |

| Research | Professional Reports, News, Trading Ideas, Market analysis, AutoChartist, Trading Central, Economic calendar | Market Analysis, Market News, Economic Calendar, AutoChartist |

| Customer Support | ||

| ✔ | ✔ | |

| Live Chat | ✔ | ✔ |

| Phone | ✔ | ✔ |

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Pros and Cons – XM Group Vs Pepperstone

XM Group

| Pros | Cons |

| A diverse collection of research and educational materials | Average fees on forex and stock index CFDs |

| Swift account opening | Limited tradable instruments |

| Minimal trading costs on the Zero Spread account | Financial information not disclosed |

| Supports MT4 and MT5 platforms | No financial protection for non-EU investors |

| Negative balance protection | Not publicly listed on the stock exchanges |

| No withdrawal fees | No cryptocurrency trading |

| Ultra-fast order execution | No fixed spreads |

| Strictly regulated by the top-tier financial regulatory authorities | Currently, Australian Forex brokers are not entitled or covered by a compensation scheme. |

75.55% of retail investor accounts lose money when trading CFDs with this provider.

Pepperstone

| Pros | Cons |

| Comprehensive research and educational tools | Financial information not disclosed |

| Fast account opening | Not publicly listed on the stock exchanges |

| Low trading costs on the Zero Spread account | No financial protection for non-EU investors |

| MT4, MT5, and cTrader platforms available | Not accessible to US traders |

| Negative balance protection | No fixed spreads |

| Free deposit and withdrawal | |

| Social copy trading capability | |

| Low spreads and commissions | |

| Supports cryptocurrency trading | |

| Faster order execution speed and low-cost trading | |

| Licensed by the top-tier financial regulatory authorities |

Tradable Instruments

Pepperstone offers more than 180 instruments. In addition to over 60+ currency pairs, cryptocurrency trading is one of the most popular services offered by this broker.

79.3% of retail investor accounts lose money when trading CFDs with this provider.

Compared to Pepperstone, XM Group allows you to trade with over 1,000 Instruments, anywhere, anytime. Its wide range of assets includes Forex, Stock CFDs, Shares, Equity Indices, Commodities, Precious Metals, and Energies. On top of 55+ currency pairs like EUR/USD and Stock CFDs from over 600 companies, you would get the option of trading Bitcoin/US Dollar (BTC/USD) with the MT5 platform.

75.55% of retail investor accounts lose money when trading CFDs with this provider.

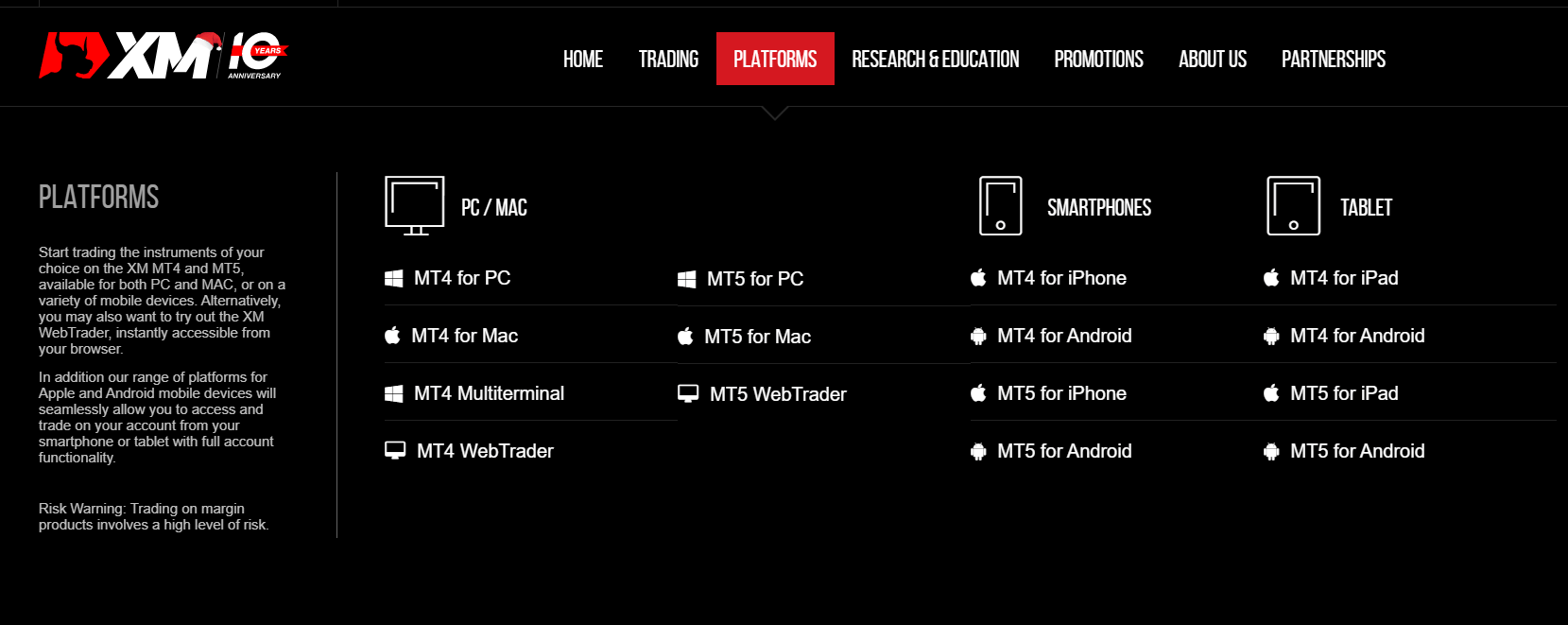

Trading Platforms

At XM Group, you can trade with the asset of your liking using the widely used MT4, MT5 platforms. These platforms feature essential tools and are optimized to run smoothly across all leading devices. Other than the MetaTrader platforms, there is the XM Group Web Trader trading platform that can be accessed via the browser. All accounts work very well on each of these platforms.

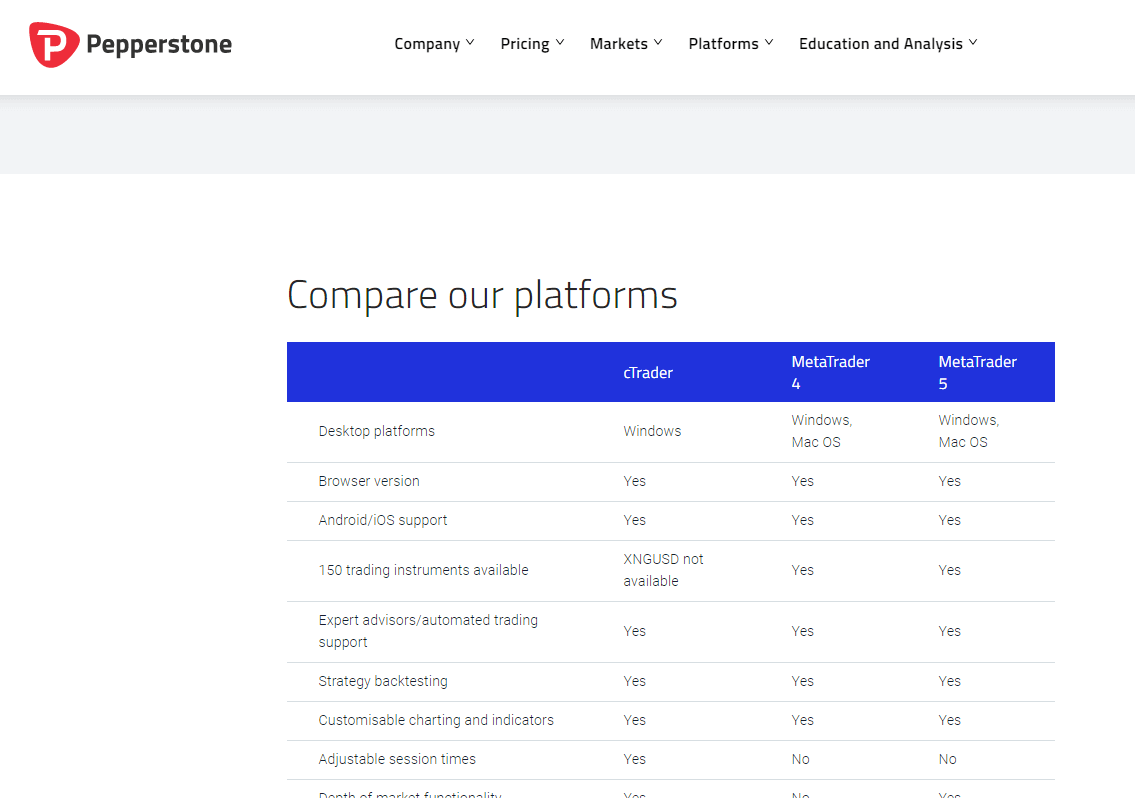

Pepperstone allows you to trade with the powerful MT4, MT5 platforms from anywhere in the world at a lightning-fast speed. The intuitive cTrader trading platform is perfect for beginners. You can access accounts on any of these platforms from any device.

Both Pepperstone and XM Group have institutional forex and CFD trading platforms with full functionality.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Trading Accounts

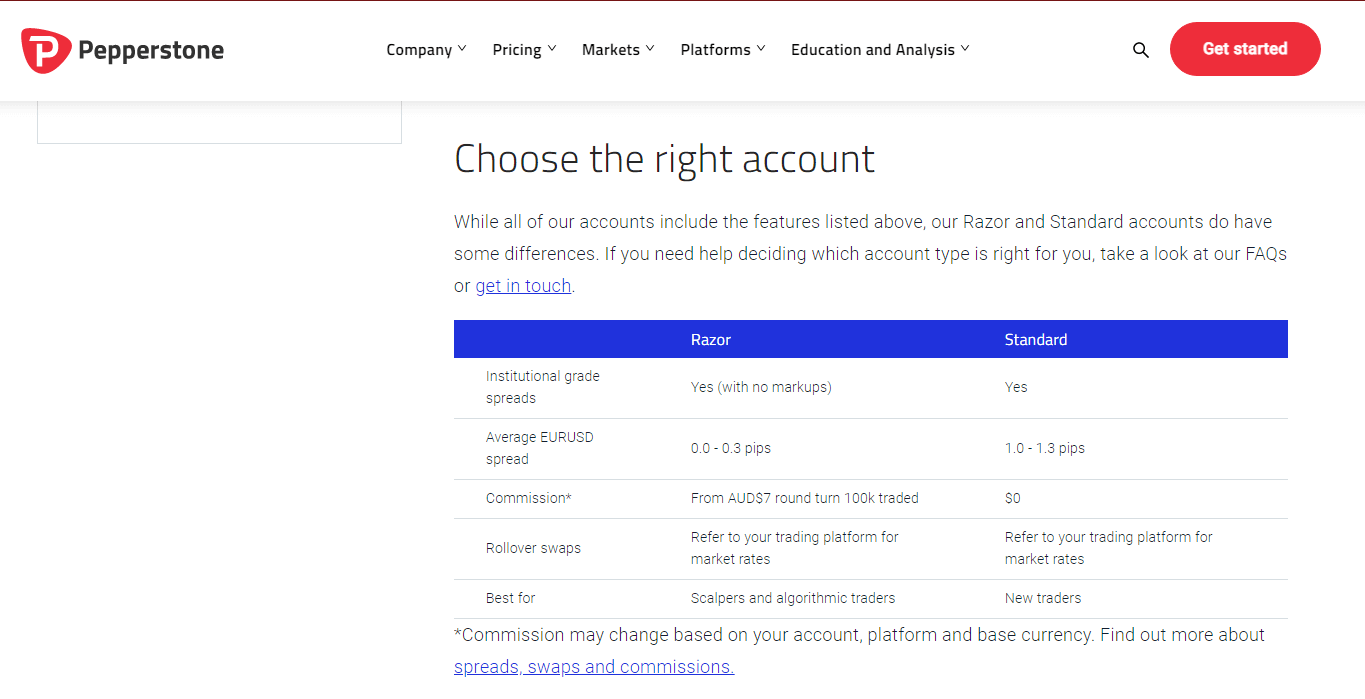

You can sign up for either a Razor Account or a Standard Account on the Pepperstone website. Both accounts include features suited for beginner and experienced traders with contrasting trading styles. The differences between these accounts are variable spreads and commissions.

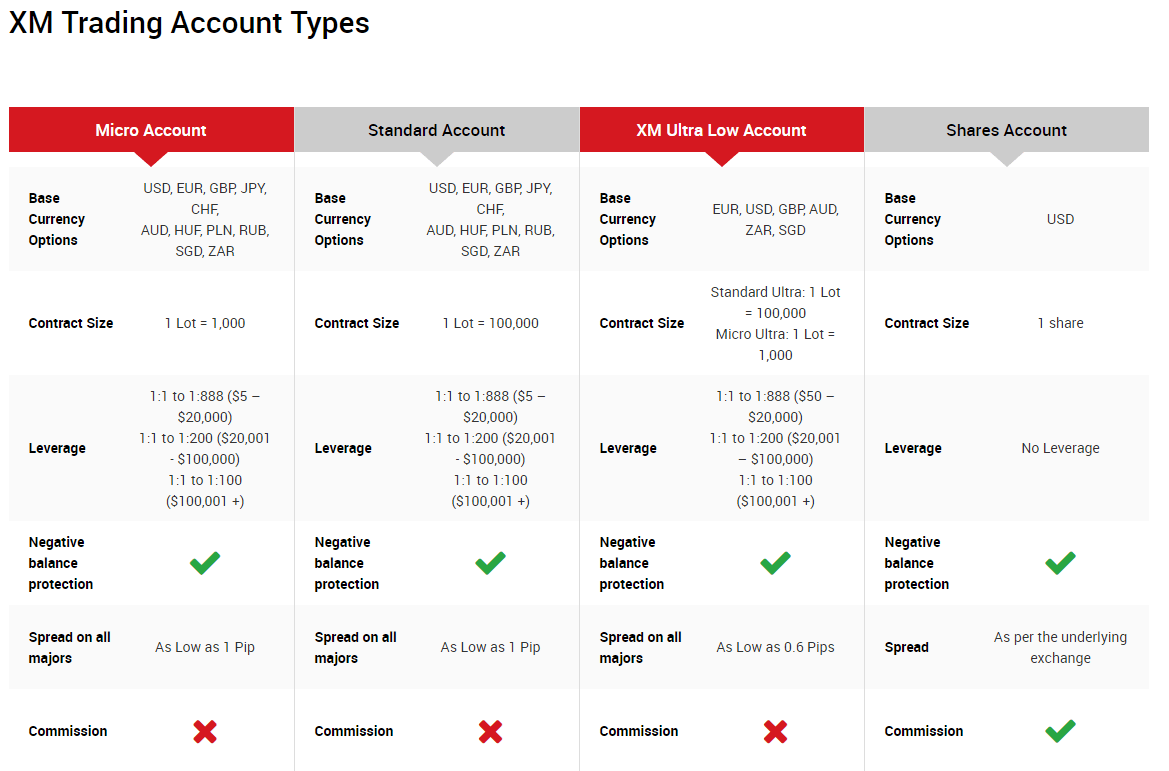

Compared to Pepperstone, XM Group has four main account types – Micro, Standard, XM Group Ultra Low, and Shares. These accounts provide you exceptional forex and CFD trading conditions with unlimited access to MetaTrader 4 and MetaTrader 5 platforms and expert advisors. Additional benefits include the ability to trade with micro or standard lots, market updates, and technical analysis. The first three accounts offer lower spreads but charge no commission, while the Shares Account requires a higher initial deposit, but there is commission.

Apart from different trading accounts, Pepperstone and XM Group offer the Demo Account and Swap-Free Account or Islamic Account. Demo Account helps new traders get accustomed to CFD, platforms, and forex trading, while Swap-Free Account of Islamic Account allows forex and CFD trading at low costs.

Minimum Initial Deposit

You can apply for a live trading account at XM Group by depositing a minimum amount. The initial minimum deposit for Micro and Standard Accounts is $5, while for XM Group Ultra Low and Shares Accounts, the minimum deposit requirements are 50$ and $10,000, respectively.

- 75.55% of retail investor accounts lose money when trading CFDs with this provider.

- Trading with Pepperstone begins by depositing a minimum of $200 for both Razor and Standard Account.

- 79.3% of retail investor accounts lose money when trading CFDs with this provider.

- In terms of the minimum initial deposit, XM Group is a better online forex broker than Pepperstone.

Payment Methods

Pepperstone offers many funding options. Transactions can be made through credit or debit cards, wire transfers, and e-wallets such as PayPal, Neteller, and Skrill. Compared to Pepperstone, XM Group supports multiple payment modes for making deposits and withdrawals. The most commonly accepted methods are credit or debit cards, bank transfers, and electronic wallets such as Neteller and Skrill.

Bonuses and Promotions

Pepperstone lets you earn premium rebates on forex trading and commissions daily through its Active Trader program. High-volume traders gain access to a range of exclusive benefits. The ratio of rebates depends on standard lots traded each month.

Like Pepperstone, XM Group treats its traders with numerous bonuses and promotions to reward their loyalty and you can learn more about their bonus program from its review. On the opening of MetaTrader 4 and MetaTrader 5 accounts, it offers you a welcome bonus of 15% up to $500 or currency equivalent. In addition to the welcome deposit bonus, this forex broker offers special seasonal bonuses a few times a year and highly exclusive bonuses on an invitation-only basis. There is also a bonus of up to $35 for each referral, along with free VPN services.

Spreads, Commissions, and Fees – XM Vs Pepperstone

XM Group offers variable and tight spreads as low as 0.6 pips on all major currency pairs like EUR/USD to all traders, irrespective of their account types and trade sizes. Furthermore, fractional pip pricing enables you to trade with the lowest possible spreads.

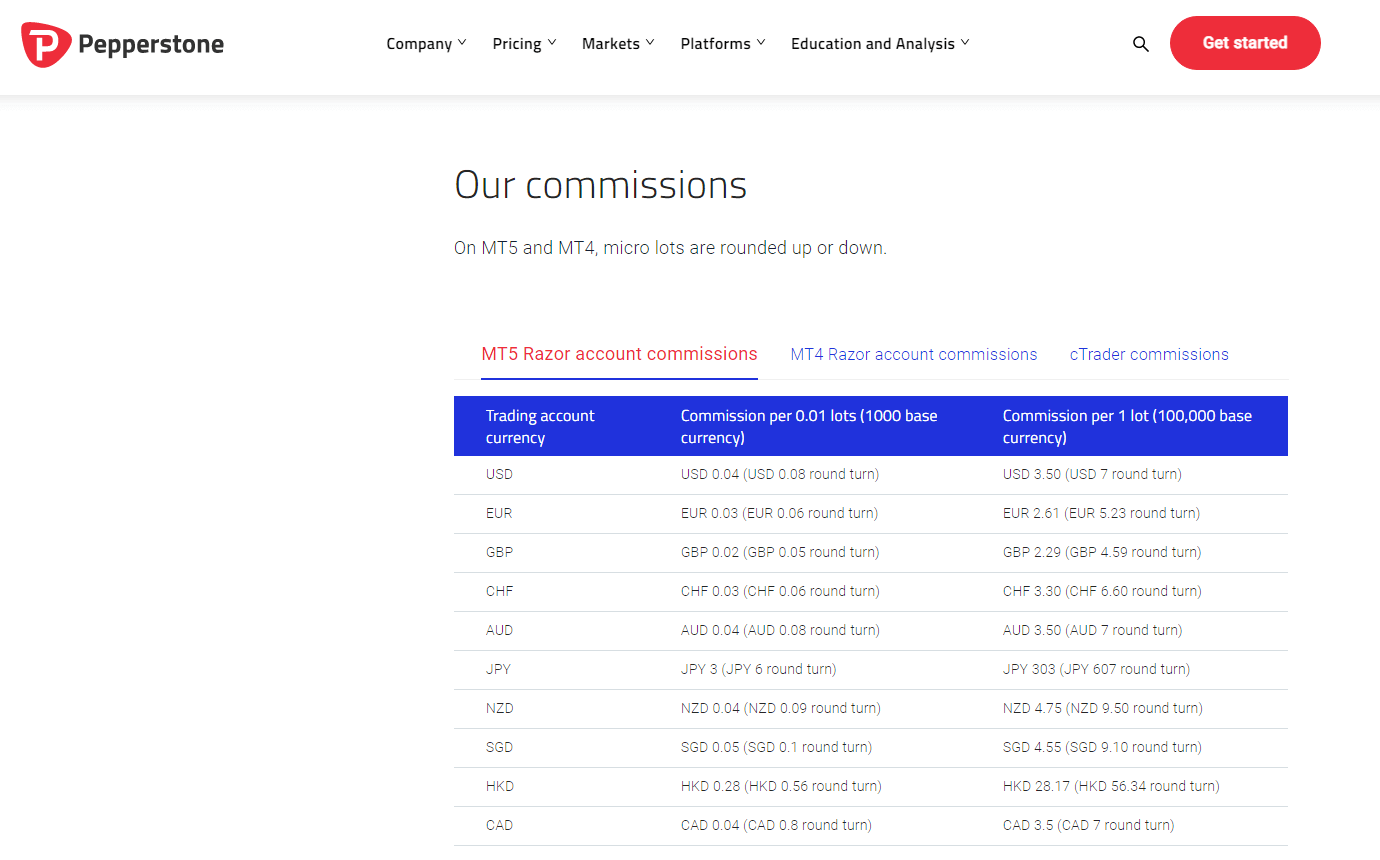

Like XM, Pepperstone offers variable and low spreads using different liquidity providers and external pricing sources. The competitive spreads are available for trading a wide range of instruments with MetaTrader 4 and MetaTrader 5 platforms.

Pepperstone and XM Group charge commissions on their respective XM Group Shares Account and Pepperstone Razor Account.

XM Group charges fees on overnight swap and account inactivity, but Pepperstone charges no inactivity fee. Neither of them charges any fee for making deposits or withdrawals.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Maximum Leverage

Depending on their account type and jurisdiction, XM Group traders can choose the maximum leverage on a scale from 1:1 to 888:1. Simply stated, the maximum leverage for traders from IFSC, ASIC, and FCA and CySEC zones is set at 888:1, 500:1, and 30:1, respectively.

Compared to XM, Pepperstone offers flexible leverage that varies with licensed traders, which means ASIC traders can get the maximum leverage of up to 500:1, DFSA traders up to or 50:1, and FCA and CySEC traders up to 30:1.

Even though leverage allows investors to trade positions larger than the trading account balance, it could lead to a higher risk of losses.

Research and Education – XM Vs Pepperstone

If you are trading with Pepperstone, you can gain access to a wide range of educational resources offered by the broker, which can be used by both new and experienced traders. It also offers webinars, articles, and tutorials covering topics from basics of Forex trading, expert advisors, trading strategy development and technical analysis, and several more. Moreover, you can also find upcoming webinars on their website and the past webinars, which are already available to the traders and can be watched anytime.

Like Pepperstone, XM provides free educational courses on the basics of Forex trading on its website. Its courses focus on technical and fundamental analysis. It also provides tutorials along with Live webinars that are hosted by experts. It provides a newsfeed and detailed economic calendar, which can be used for researching financial markets.

Licensing and Regulation – XM Group Vs Pepperstone

Both brokers, XM Group and Pepperstone, are trustworthy online forex brokers. Not only do they adhere to the strict international standards, but they have gained licenses from multiple top-tier financial regulatory authorities.

XM Group is regulated by the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the International Financial Services Commission (IFSC) in Belize. While Pepperstone is overseen by the Australian Securities and Investments Commission (ASIC), the UK Financial Conduct Authority (FCA), the Dubai Financial Services Authority (DFSA), and the Securities Commission of the Bahamas (SCB).

Security of Funds – XM Vs Pepperstone

Trading forex and CFDs can result in significant losses; hence the investment advice is to trade with a regulated online broker. Both brokers, XM Group and Pepperstone have investor protection policies in place that ensure the safety of clients ‘ funds. Guaranteed protection of the trader’s money is ensured by the statutory compensation schemes enforced under FCA and CySEC guidelines.

Because of being regulated by international agencies, XM Group and Pepperstone keep the trader’s funds in segregated accounts at top-tier banks. It avoids the mix up of the client funds with company funds as well as prevents the misallocation of trader funds. These measures turn to be effective in the events of global financial crises or bankruptcy of the broker.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Risk Management Tools – XM Group Vs Pepperstone

Since forex and CFDs are complex instruments, you are always at risk of losing more than your investment. Both brokers, XM Group and Pepperstone, integrate several risk management tools to protect you from facing the unexpected loss of funds. Let us look at the tools on their websites.

Margin Monitoring: XM Group allows you to control your real-time risk exposure by monitoring used and free margin.

Margin Call: XM Group’s margin call policy guarantees that the trader’s maximum possible risk will never exceed their account equity.

Leverage Risk: XM Group provides a leverage range that helps you choose your preferred leverage risk level.

Stop-Out Level: At XM Group, when the equity in the trader’s trading account reaches or falls below 20 percent of the required margin, open positions get automatically closed at the set equity level.

Stop Loss Order: To help you manage your CFD and forex trading risk, both brokers offer the stop-loss order function. Using this feature, you can set a price level to secure your positions. If the trade surpasses that level, the forex broker closes the trade automatically.

Negative Balance Protection: Zero balance protection is a helpful feature offered by both brokers as it stops the trade when the trader’s account balance touches the zero mark.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Customer Service – XM Vs Pepperstone

There is not much difference between the XM Group and Pepperstone when it comes to customer service. You can contact their multilingual customer service representatives 24/5 via email, live chat, or the phone. What we found contrasting is the longer than usual response time XM Group takes to solve client queries. Pepperstone, on the other hand, provides prompt support by fixing any concerns raised by traders.

Verdict – XM or Pepperstone

XM Group offers a wider range of instruments and account types, which give you a wide range of choices in trading. Traders who wish to trade with Bitcoin can do so with this broker. Four trading accounts starting with the nominal amount of $5 make it feasible for you to choose the one that best suits your requirements. The broker facilitates automated trading with the advanced MetaTrader 4 and MetaTrader 5 platforms, allowing novice traders to make profits by trading multiple assets. Bonuses and incentives offered by XM Group are for everyone – new members, loyal members, and referrals get rewarded for everything.

The ECN broker, Pepperstone, has limited instruments and fewer trading accounts with higher initial deposits, which most traders might not find tempting. But there are some areas where it takes the lead over XM Group. The intuitive cTrader platform that creates an institutional trading environment for investors, crypto trading, and no account inactivity fee are something hard to ignore. Plus, its Active Trader Program is an excellent opportunity for you to earn rebates on forex trading.

Both brokers, XM Group and Pepperstone, offer variable spreads, maximum leverage, investor balance protection tools and are regulated by international authorities. These brokers also have the copy trading feature.

Overall, both brokers are reliable. XM Group can be a better option for you if you are looking for variety, low initial deposit, and bonuses, while Pepperstone could be an ideal deal for those whose choices are limited but seek a modern online broker.