XM Vs IC Markets: The Complete 2023 Analysis

Traders, especially newcomers and amateurs, often compare XM and IC Markets. Considering XM vs IC Markets, both trading brokers have certain common features and also differences. Every trader is different and has their own set of preferences. That said, XM may seem like a better choice for some, and IC Markets may suit others. Let’s list the similarities and differences of both to understand which broker is an ideal one for your trading needs in this XM vs IC Markets comparative review.

Background

XM is an STP broker founded in 2009 that trades in Forex, CFD, cryptocurrency, oil, etc. It is one of the most popular, highly regulated forex brokers with over 3,500,000 clients from across the world.

XM Forex Broker

XM Forex Broker

While XM is the recommended online broker for traders seeking STP broker, IC Markets is a great option for traders interested in an ECN broker.

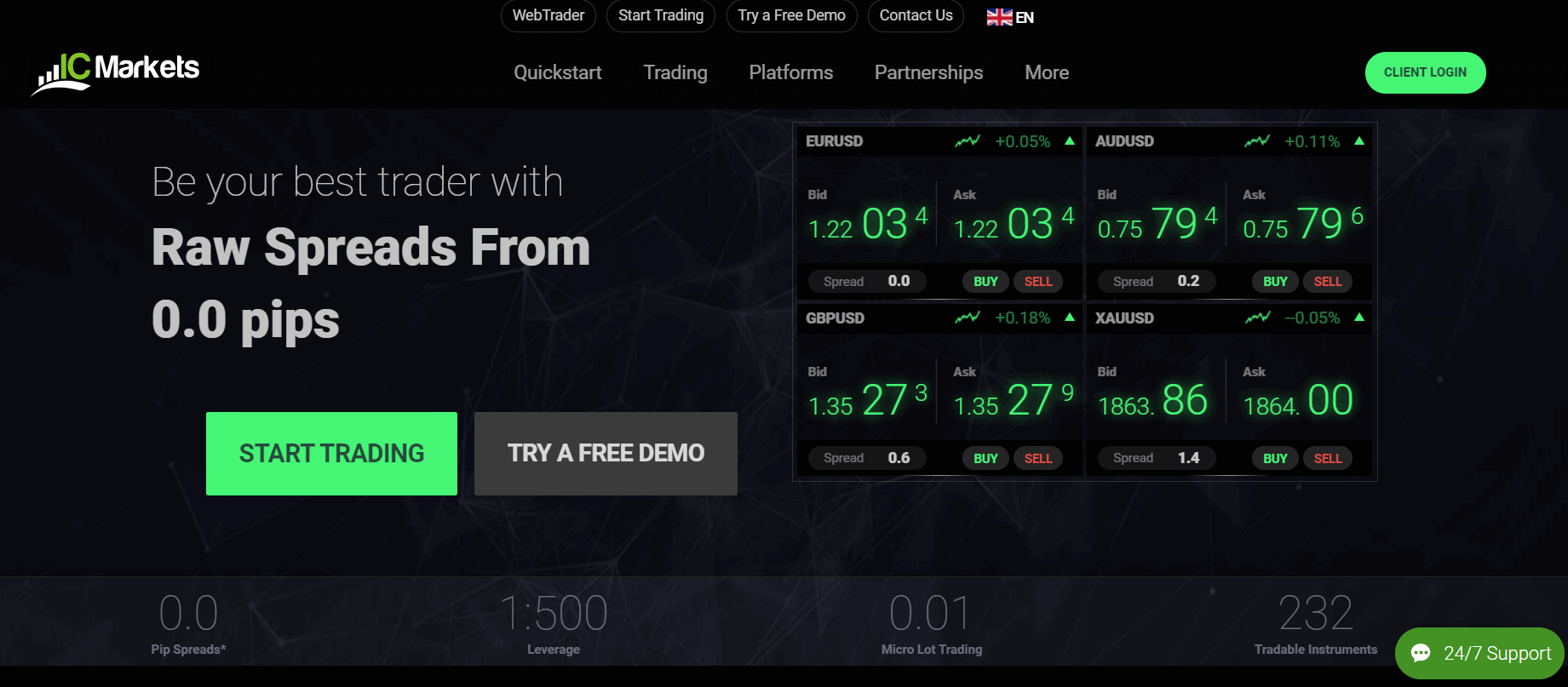

IC Markets, an ECN broker, was founded by entrepreneur Andrew Budzinski in the year 2007. Headquartered in Sydney, Australia, IC Markets is a true ECN broker trading CFDs, Forex, bonds, etc., predominantly in Europe and Asia.

If you aren’t sure about whether to trade with XM or IC Markets, this review will help you make an informed choice.

XM Vs IC Markets: A Direct Comparison

| Trading Features | XM | IC Markets |

| Automated Trading | Yes | Yes |

| Hedging | Yes | No |

| Swap Trading | Yes | No |

| Mobile Trading | Yes | Yes |

| API-based Trading | No | Yes |

| One Click Trading | Yes | Yes |

| OCO Orders | No | No |

| Trailing Stop | Yes | Yes |

| Pending Orders | Yes | Yes |

| Personal Manager | Yes | No |

| Affiliate Program | Yes | No |

| Trading Education | Yes | Yes |

| Trading Instruments | XM | IC Markets |

| CFD | Yes | Yes |

| Forex | Yes | Yes |

| Binary Option | No | No |

| Gold and Silver | Yes | No |

| Cryptocurrencies | Yes | Yes |

| Indexes | No | No |

| Bonds | No | Yes |

| Oil | Yes | No |

| Energies | No | No |

| ETF | No | No |

| Stocks | No | No |

| Soft commodities | No | No |

| Options | No | No |

XM Vs IC Markets: An Overview

IC Markets has high-speed order execution enabled by Equinix data centers.

XM has 1000+ markets compared to the 230+ markets offered by IC Markets. XM does not charge commissions as it is an STP broker. The Standard Account at IC Markets is commission-free, while the cTrader Raw and Raw Spread account types charge commissions.

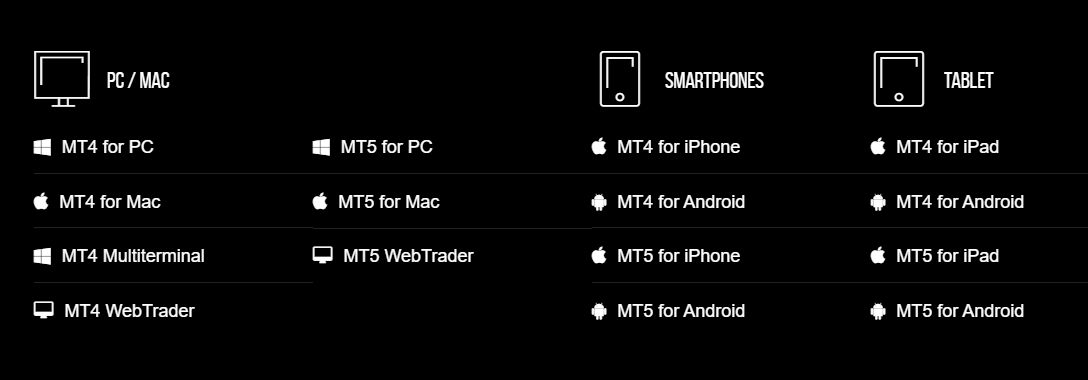

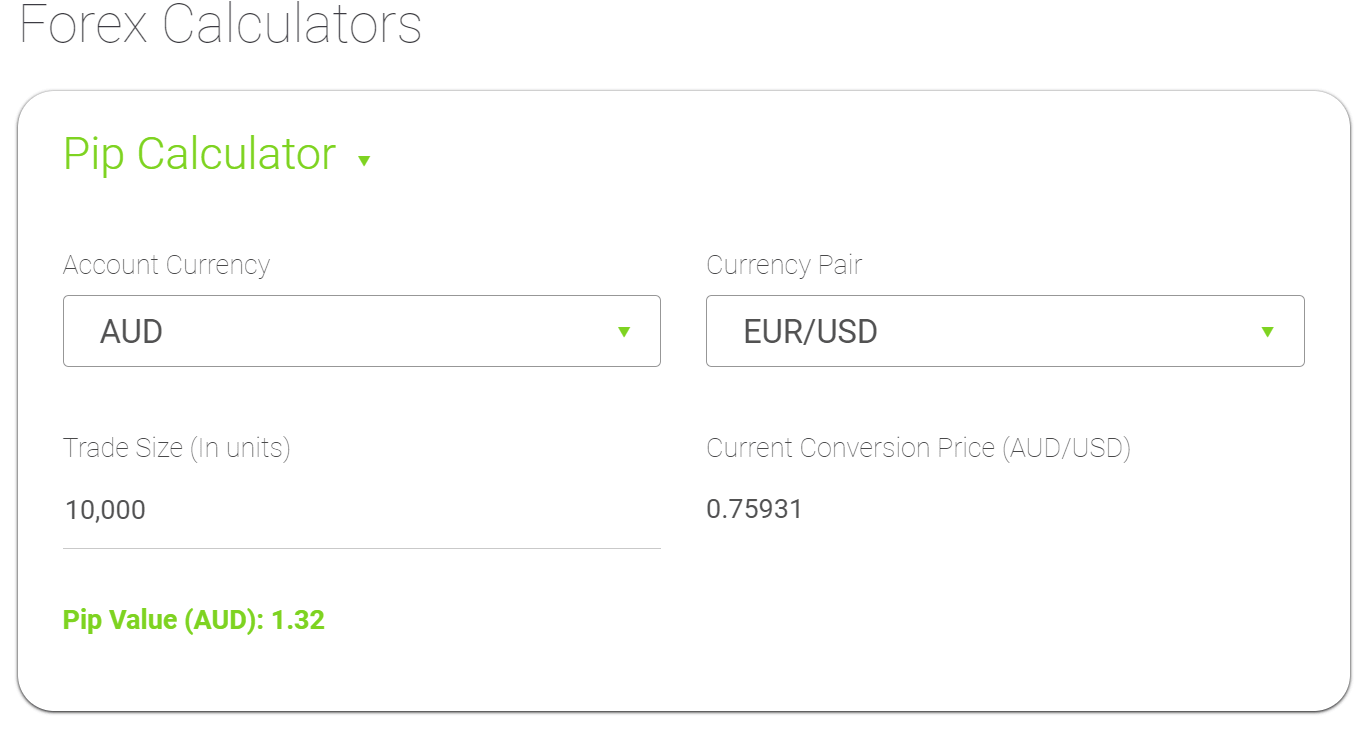

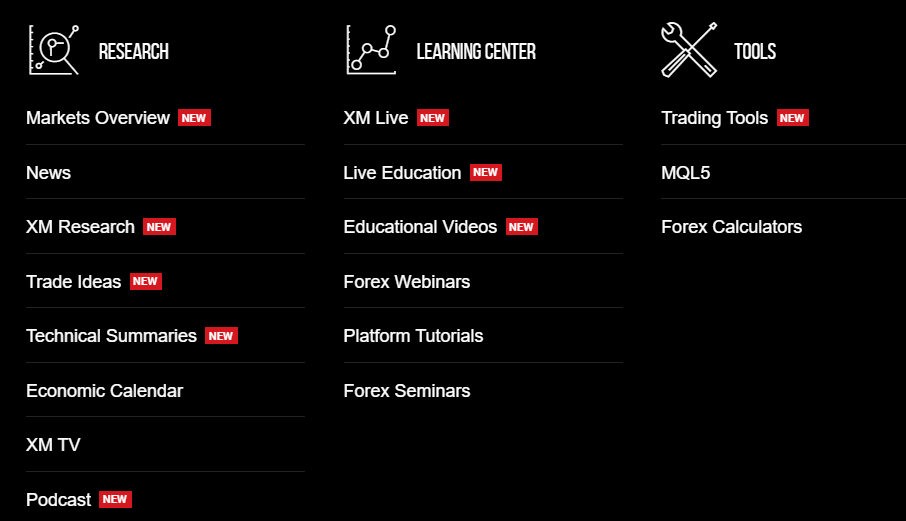

Both XM and IC Markets support MetaTrader 4 and 5 (MT4, MT5) platforms. IC Markets hosts the cTrader trading platform as well. Both brokers have free resources on trading education. IC Markets provides free educational articles, video tutorials, market analysis, Web TV, trade ideas, and market commentary on its website. The XM trading platform has video tutorials, technical analysis, market outlook, webinars, Forex market research, and daily Forex signals.

Trading Platforms supported by XM

IC Markets supports both social and copy trading via ZuluTrade and Myfxbook, respectively, while XM has Mirror Trader for proven trading strategies.

Both IC Markets and XM are regulated by the ASIC in Australia and CySEC in Cyprus. While XM is regulated by the IFSC in Belize, IC Markets is regulated by the FSA in Seychelles. XM is also regulated by CNMV in Spain, CONSOB in Italy, FAC in the UK, and FSP in New Zealand.

Another common feature is that both the brokers support trading of 0.01 lots or micro-lots. XM offers trade sizes as small as 0.0001 lots as well.

Why Retail investor accounts lose money when trading CFDs

Both IC Markets and XM provide opportunities for CFD and Forex trading. Although associated with high risks, CFD and Forex trading are popular options for earning high returns. XM is predominantly a CFD and Forex broker, but the trading platform also has trading instruments like oil, gold, and silver, cryptocurrencies, among others. As is the case with all forex brokers, retail investor accounts lose money when trading CFDs with this provider as well.

Typically, CFD and Forex trading are risky investments. In fact, CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. However, the same leverage may also trigger profitable trades.

60%-80% of retail investor accounts end up losing money rapidly due to over-leveraging their exposure to the markets when trading CFDs. CFDs are complex instruments and come with a high risk. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. You want to choose a broker that offers educational resources that will help you balance risk and reward.

One of the most important elements of any CFD trade and one that should factor into the decision-making process in every single CFD position you take is the position of your stops. Unfortunately, traders often seem to trend towards neglecting stops over time. Always position stops at sensible levels, regardless of how confident you feel about a particular trade. Judging where to set the stops is something that comes more naturally with experience

Another common difficulty with CFDs comes from fundamentally misreading the markets, often spurred on by a lack of research. Both XM and IC Markets update their websites with research on a daily basis. This can be helpful to new traders.

XM Vs IC Markets: Account Types

XM Forex Broker Trading Accounts

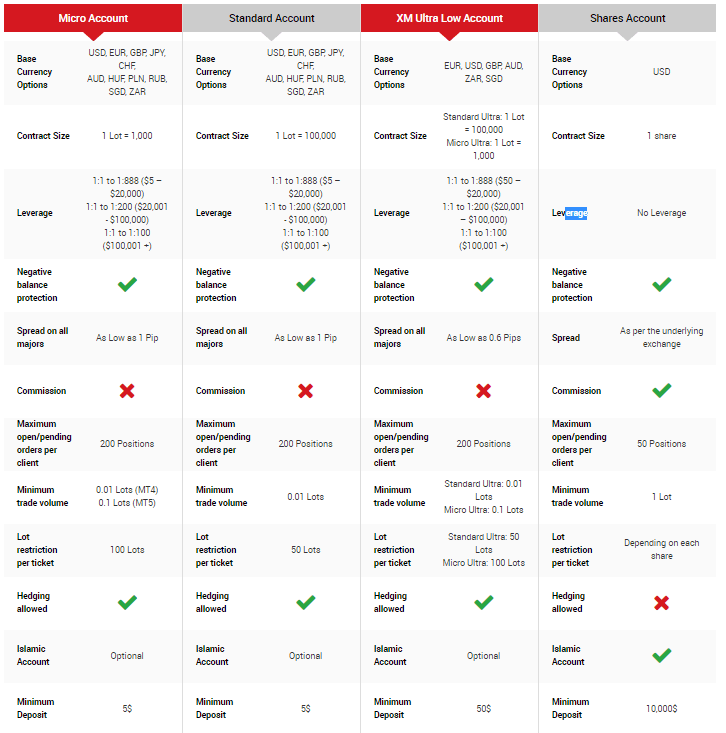

XM Forex brokers have Micro Trading Account, Standard trading Account, XM Ultra Low, and Shares Trading Account. All of these trading account types support MT4, MT5 platforms. In fact, these accounts also offer negative balance protection.

As the name suggests, the Micro account facilitates trading in micro lots. Ideal for traders seeking lower risk levels, the Micro account has the lowest minimum deposit of $5. This account type is preferred by new traders.

The standard account is for traders interested in operating with standard lots. Similar to the Micro account, one can open a standard trading account with a minimum deposit of $5. The XM Zero account is a type of standard account where the lower spreads start at 0 pips. It differs from the standard account with the minimum deposit requirement of $100.

XM Ultra Low account is for traders interested in micro and standard lots. The lower spreads in the Ultra Low account start at 0.6 pips, and the initial minimum deposit is $50. Readers are advised to note that the Micro, Standard, and Ultra Low account types operate commission-free. However, the Shares account type charges a commission. Also, the Shares account offers no leverage and does not support hedging. The minimum deposit required to open a Shares Account is $10,000.

IC Markets Trading Accounts

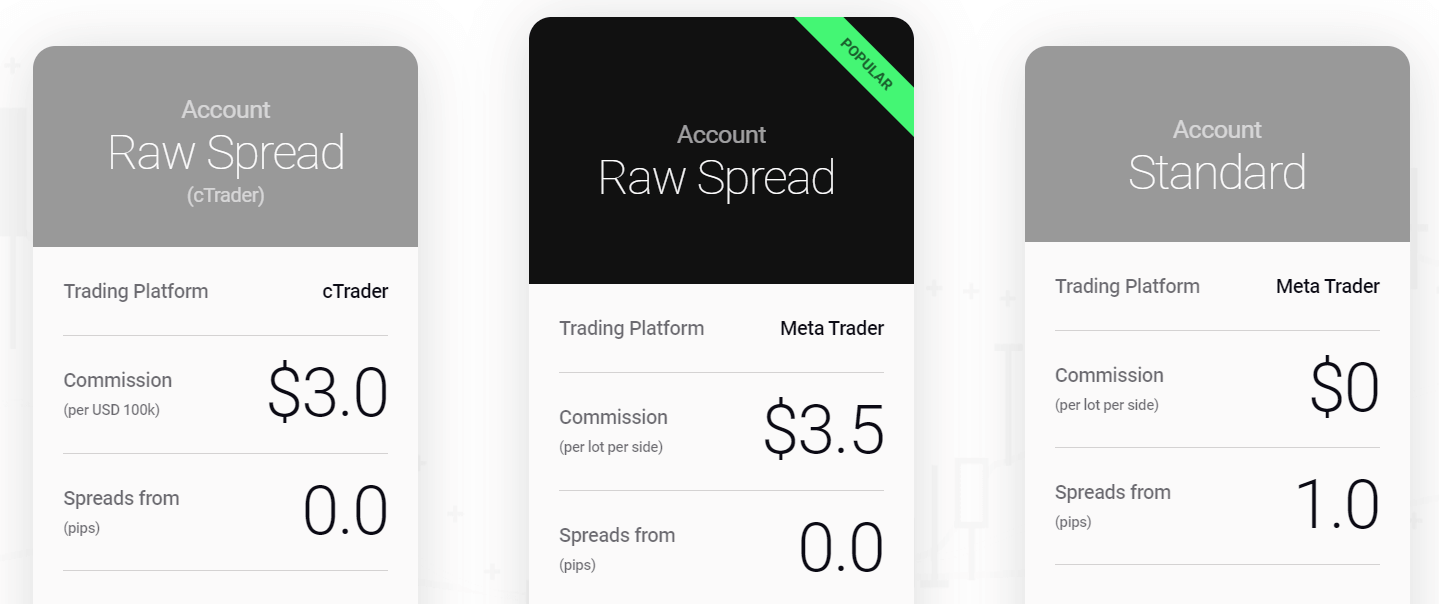

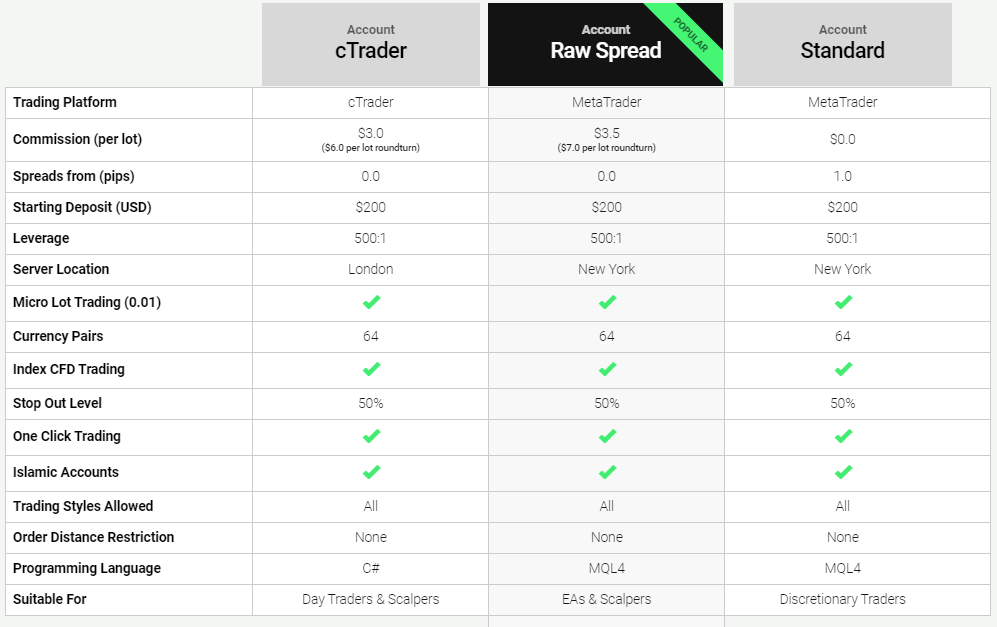

cTrader, Account Raw Spread, and Account Standard are the different types of IC Markets trading accounts.

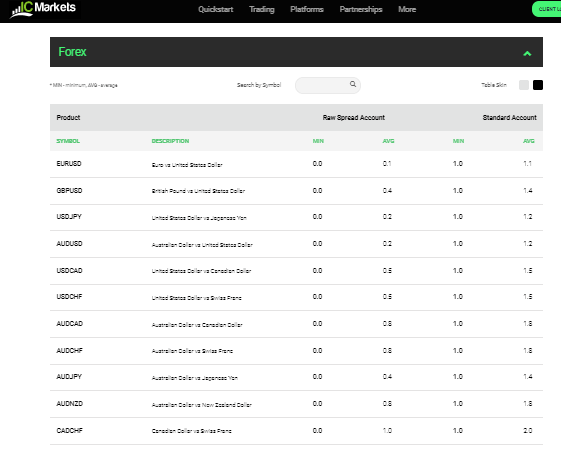

One of the characteristics of the cTrader account is that there are no minimum spreads. In fact, the lower spreads in the cTrader account start at 0.0 pips (EUR/USD Forex pairs). The average spread during European and North American trading sessions (EUR/USD Forex pairs) is 0.1 pips, which is the tightest average spread for EUR/USD Forex pairs across the world.

The Raw Spread Accounts is known for its lowest spreads with an average of 0.1 pips for EUR/USD Forex pairs. This account is ideal for scalp and day traders. The Raw Spreads Account hosts MT4, MT5 trading platforms, which support scalping and day trading.

The Standard account is suitable for automated trading, scalp trading, and high frequency trading, as there are no trading restrictions. The spreads start from 1 pip, and this account operates on the Equinix NY4 servers in New York. It also supports the MT4, MT5 platforms.

IC Markets Risk Warning: Retail investor accounts lose money when trading CFDs with this provider. You are advised to consider whether you can afford to take the high risk of losing your money before investing.

XM Vs IC Markets: Salient Features

Trading Platforms

Trading platforms are software tools used to manage and execute market positions. These online platforms also offer price charts, analytical, and other trading tools for developing trading strategies. Both IC Markets and XM Forex brokers host trading platforms like MT4, MT5 that support one click trading. Apart from MetaTrader 4 (MT4) and MetaTrader 5 (MT5), IC Markets also supports trading systems like cTrader, ProDeal, and webiRESS. Professional traders prefer trading on MetaTrader 4 and MetaTrader 5 as these platforms facilitate mobile trading, trailing stops, and pending orders.

Trading Instruments

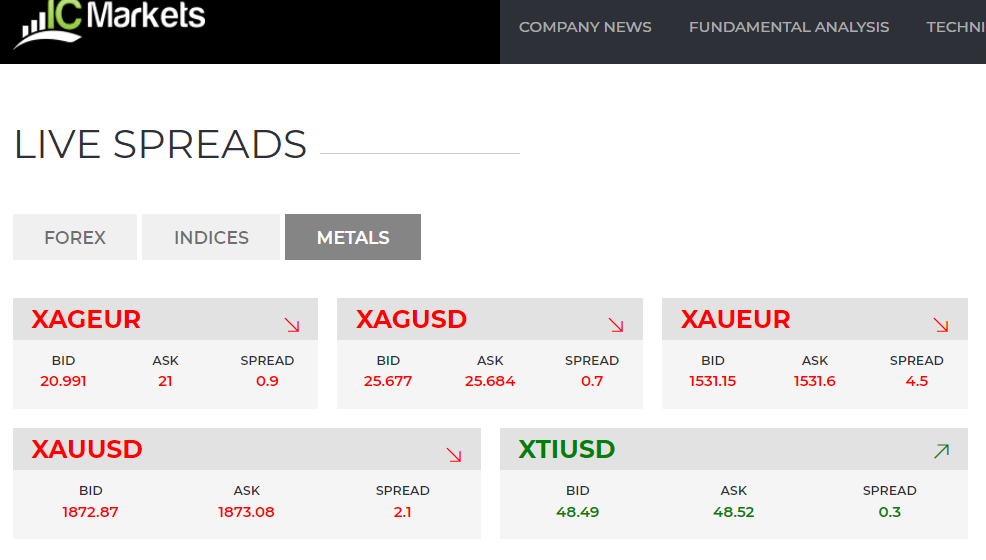

Professional CFD and Forex traders always look for ways to diversify their trading portfolios. In this endeavor, they look for a myriad of trading instruments apart from currency pairs. Both IC Markets and XM Forex brokers offer a plethora of other trading instruments. Along with trading of CFDs and currency pairs, IC Markets also offers trading instruments like bonds, cryptocurrencies, among others, on its MT4, MT5 platforms. XM Forex brokers also offer gold and silver, oil, cryptocurrencies, and other trading instruments on MT4, MT5 platforms.

The cryptocurrencies supported on XM’s MT4 and MT5 platforms are Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and Ripple. IC Markets enables the trading of cryptocurrencies that include Bitcoin, Ethereum, Litecoin, Bitcoin Cash, Ripple, Dash, Emercoin, Namecoin, Peercoin, and EOS on its MT4 and MT5 platforms.

Demo Accounts

At XM, you can keep your demo account parallel to your trading account for an unlimited time. You have the freedom to use your demo account to test strategies and then use the most effective ones on your real account.

IC markets allows you to select the opening balance in simulated accounts. What’s more, there’s no expiry date, making it easier to track your progress. Opening a demo account with IC markets couldn’t be easier. What’s more, they have MetaTrader 4 (MT4) and MetaTrader 5 (MT5), and cTrader platforms available to choose from, as well as a wide range of currency pairs, metals, and CFDs – all trading with attractive spreads.

Trading Fees and Other Charges

Except for the Shares Account, XM does not charge commissions or other fees. Also, XM does not charge any deposit and withdrawal fee. XM covers all deposit and withdrawal transfer fees for payments made via Neteller, Moneybookers, and all major credit cards (including VISA, VISA Electron, MasterCard, Maestro, and China UnionPay). Additionally, all deposits and withdrawals above 200 USD processed by wire transfer are also included in our zero fees policy. However, the online broker charges an inactivity fee or dormant fee of $5 every month for trading accounts that remain active for more than 90 days.

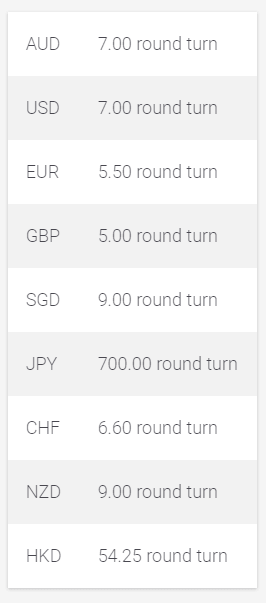

In the case of IC Markets, the online broker does not charge a commission for its Standard Account. Nevertheless, a spread markup of 1 pip applies for the Raw Spread account. Also, a standard commission of $7/standard lot applies for other accounts. Like XM, IC Markets does not charge any additional withdrawal or deposit fee.

Copy Trading

IC Markets enables copy trading via its AutoTrade feature that is facilitated on both MT4 and MT5 platforms. On the other hand, XM brokers do not support copy trading. However, the online broker allows copy trading via third-party trading platforms other than MT4, MT5.

Payment Methods

XM online brokers offer a myriad of payment options ranging from e-wallets to credit cards like Visa, MasterCard, Maestro, etc. Some of the other payment options include Skrill, Moneybookers, ChinaUnionPay, Neteller, SofortCashU, bank transfer, and international bank wire. While there are fees for deposit or withdrawal, for deposits under $200, XM charges a $20 deposit fee for international wire transfer.

IC Markets has more payment options compared to XM online brokers. Some of the payment methods include credit card, wire transfer, Thai internet banking, Vietnamese internet banking, wire transfer, UnionPay, Neteller, Skrill, Bpay, Rapid Pay, Klarna, PayPal, Bitcoin Wallet, among others.

Investor Protection

XM has negative balance protection that applies to all types of XM accounts. IC Markets does not have this feature.

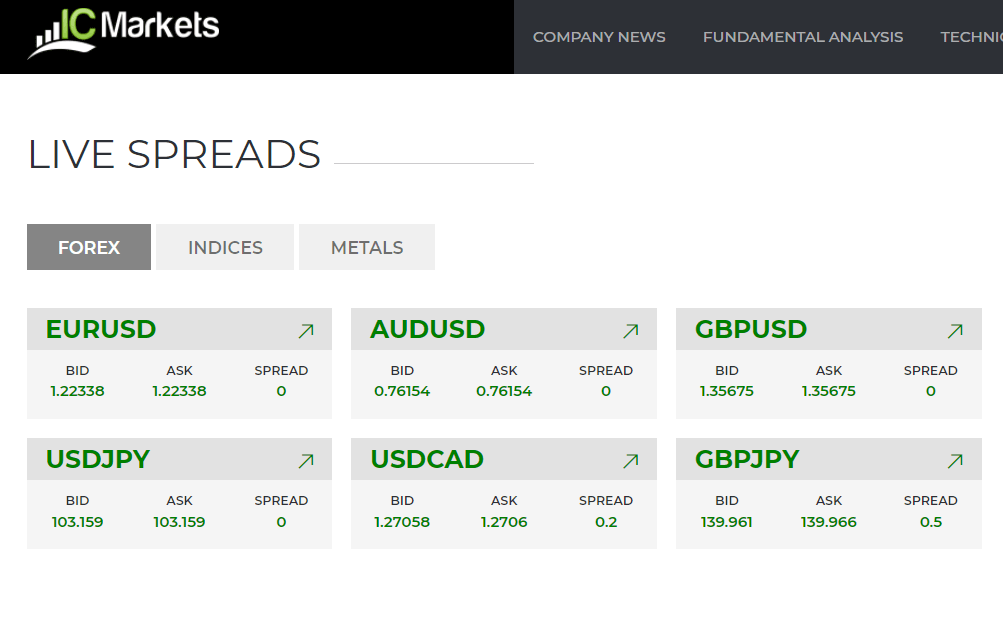

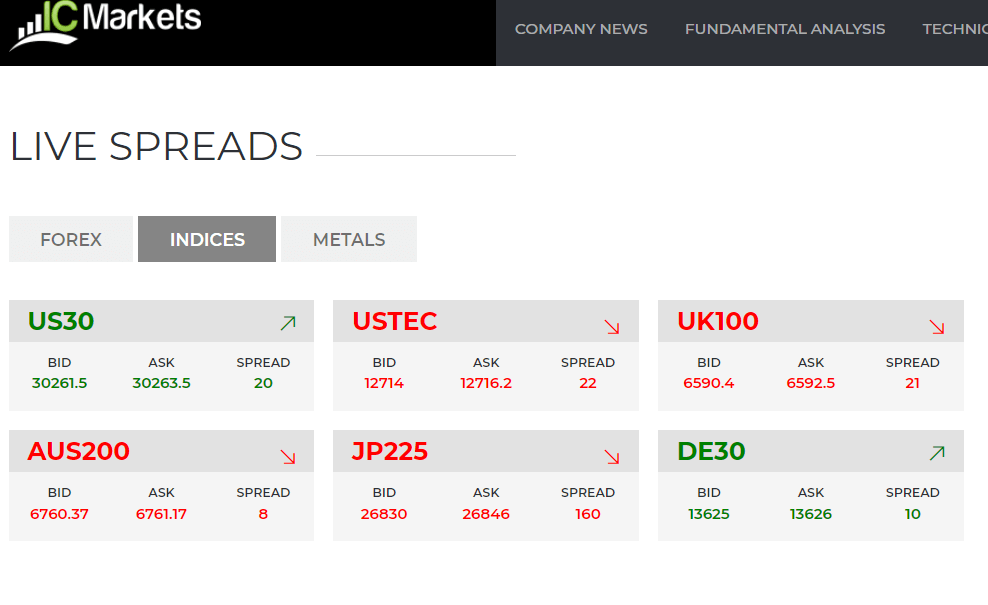

Spreads and leverage

Forex spreads at IC Market start from 0, for which the broker charges a commission. The online broker does not charge a commission for spreads starting from 1. The same applies to XM, where they charge a commission for a spread size of 0. However, they do not charge a commission for spreads from 0.6 onward. The maximum leverage varies as per the regulating body. For example, With IC Markets, the maximum leverage for CySEC regulated zones is 30:1, while for FSA regulated regions, it is 500:1. Every trader should know that trades come with a high risk of losing money rapidly due to leverage. You should consider whether you can take a high risk.

XM Vs IC Markets: Accepted Countries

Traders from Australia, Thailand, United Kingdom, Singapore, Hong Kong, India, France, Italy, Germany, Denmark, Norway, United Arab Emirates, Sweden, Luxembourg, Kuwait, Qatar, Saudi Arabia, to name a few, can access XM. Nevertheless, XM cannot be accessed by users from the United States, Israel, Portugal, Iran, and Canada.

Australia, United Kingdom, Singapore, Thailand, South Africa, India, France, Germany, Norway, Hong Kong, Sweden, Italy, Denmark, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar, to name a few, are some of IC Markets accepted countries. Some of the IC Markets restricted countries include the United States, Canada, Zimbabwe, Iran, Iraq, Ghana, Côte D’Ivoire, Cuba, etc.

XM Vs IC Markets: Customer Service

IC Markets provides live chat, phone, and email support 24/7. Readers are advised to note that users from Europe and the UK can reach the support team between Monday and Friday.

Similar to IC Markets, XM also offers customer support via live chat, email, and phone. XM offers customer support only five-days and week.

XM Vs IC Markets: Pros and Cons

XM Pros

- Offers negative balance protection

- Highly regulated broker

- Commission-free trading accounts

XM Cons

- 75.55% of retail accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

- Not listed on stock exchanges

IC Markets Pros

- True ECN broker

- Offers innovative trading tools including technical indicators

- Supports copy trading

IC Markets Cons

- Negative balance protection only for European traders

- Not listed on any stock exchanges

- 74.25% of retail CFD accounts lose money with this provider

Safety of Client Funds

IC Markets and XM protect their clients’ funds. At XM, Guaranteed protection of the trader’s money is ensured by the statutory compensation schemes enforced under CySEC guidelines. IC Markets offers protection of clients’ funds by holding the client’s funds in the Segregated Client Trust Accounts at NAB and Westpac. Further, all online payments made to IC Markets are protected by SSL encryption technology.

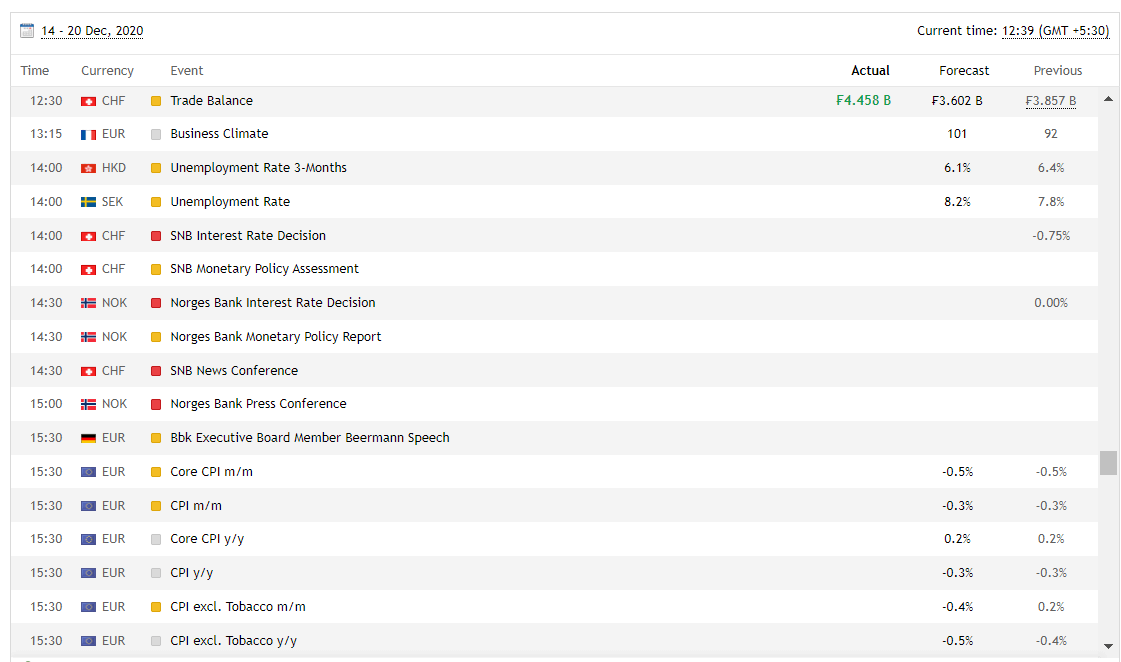

Market Alerts

Both IC Markets and XM send price alerts via various trading tools like market indicators, Forex calendars, etc. These brokers also have market charts and indicators, technical and fundamental analysis for timely price alerts for executing lucrative trades.

The Verdict

Every trader is different with their very own requirements and preferences. Both XM or IC Markets, both offer a unique set of features and tools for a broad spectrum of traders. The key is to identify one’s trading needs to determine the best Forex broker for trading a myriad of trading instruments. If you’re looking for a broker with low spreads on popular instruments like EUR/USD, XM Group is likely a better option. However, if you want a broker with ECN execution, IC Markets may be more appropriate.