Esther’s New Staking Model Draws the Attention of SEC

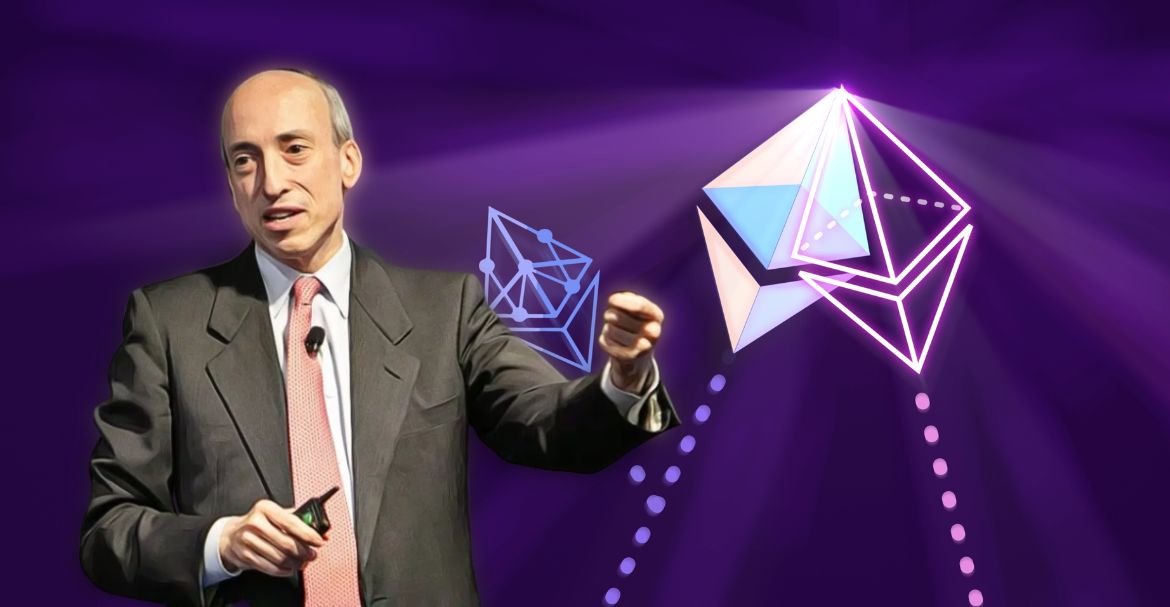

After close and careful observation, the Chairman of the Securities and Exchanges Commission, Gary Gensler, believes that Esther’s newly introduced staking model could, in all probability, set off and activate securities laws. According to him, all cryptocurrencies and mediators who are in the line of permitting holders to stake their respective coins may have to go through the Howey test.

Courts adopt this critical test to understand and evaluate whether an asset is a security. The test is conducted to comprehend when investors are looking to receive returns from third-party labors.

All firms providing their clients’ securities in stocks and bonds must register with the commission and make complete disclosures judiciously. This has to comply with the law to protect and safeguard investors’ assets in a more than secure way, also stemming the opportunities of any discrepancies that may arise due to any kind of wrongdoings, whether intended or not.

Ether, one of the largest cryptocurrencies, takes the help of staking to substantiate transactions. This also assists investors in locking up their tokens for a predetermined time to be in a position to gain returns.

In the case of mediators, the form of a crypto exchange provides staking facilities and options to its clients. It could amount to the simple act of lending. Therefore, considering this very scenario, for a while, the Securities and Exchanges Commission has repeatedly been cautioning bodies in the line of providing crypto-lending products to strictly register themselves with the Commission and thus adhere to the guidelines.