XM Vs FXCM Brokers 2023

XM or FXCM, which one is better? Both brokers are often compared to each other, but it’s important to understand that every trader is different, and what may be suited to your trading needs may not work for someone else or vice versa. To make it easier for you to decide which one is the best fit for you, we’ll review and compare features and functions:

XM

Features

XM Forex Broker – Key Features

XM Forex Broker – Key Features

- XM Group was founded in 2009 and is a well-reputed online broker; its parent company is Trading Point Holding, which is a recognized global forex and CFD broker. Trading point holding provides two brands such as Trading.com and XM.

- XM functions as per the required regulations, and it segregates the clients’ funds from their company’s funds, and are held in tier-1 banks for safety.

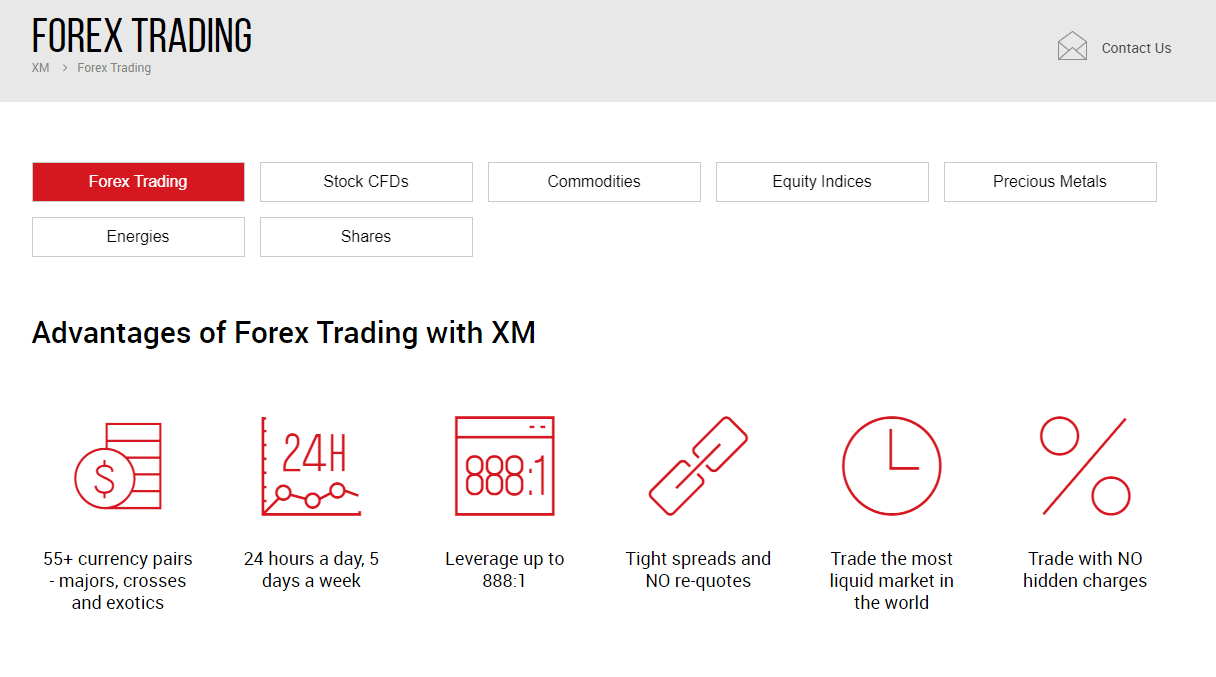

- XM brokers have over 1000+ trading instruments, which include forex, indices, stocks, metals, commodities, and energies. We get to know from XM review that XM website offers trading platforms that are globally recognized like Metatrader 4 and Metatrader 5, which can be used on Mac, PC, IOS, Android, and web, which supports one-click trading. One-Click trading is a quick 1-step process that lets you execute trades with a single click and no secondary confirmation from the trader. This function is implemented to simplify the trading process and to reduce the order execution time and is perfect for more experienced traders who value speed in their operations.

- The XM Zero Spread Account features spreads as low as zero pips, leverage up to 500:1, and one-click trading with a deposit of $100.

- XM group clients benefit from its several account types. Each account has unique benefits and features. Also, this broker is an STP broker. XM provides a commission-based and commission-free account, swap-free Islamic account, and demo trading account for the benefit of its users.

- XM Group has an array of education and research tools such as market analysis, live webinars, live educational tools, videos.

- XM group live support is available 24 hrs, Monday through Friday, via email, phone, and live chat in Arabic, Chinese, English, French, German, Greek, Hungarian, Indonesian, Italian, Japanese, Korean, Malay, Polish, Portuguese, Russian, Spanish, Swedish, Thai and Hindi.

- 69.10% of retail investor accounts lose money when trading CFDs with XM.

Regulation

The XM group was founded in 2009, and the XM brand is regulated by authorities like CYSEC. XM group’s entity was established in Cyprus, and it is regulated by CySec. XM is regulated by ASIC in Sydney and FCA in London.

Awards

The XM Group has many awards in its hat:

- Best Customer Service Experience – Global – Awarded by Global Business Awards 2020

- Best FX Service Provider for 2020 – Awarded by City of Wealth Management Awards 2020

- Best Customer Service Global 2019 – Awarded by Capital Finance International Magazine (CFI.co)

- Best Market Research and Education Global 2019 – Awarded by Capital Finance International Magazine (CFI.co)

- Best Trading Support for 2017 – Awarded by Capital Finance International Magazine (CFI.co)

Location of the Forex Brokers Compared

- FXCM has its head office in London and has several branches around the world. FXCM provides a browser-based platform, but the users can choose either Metatrader 4 or the desktop version.

- XM Group, which was formerly known as XEMarkets, is a forex broker based in Cyprus. It was established in 2009, and it is regulated by the British Financial Conduct Authority (FCA) and CySEC. It complies with several regulatory authorities around the globe.

Risk Warning – CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Around 74% to 89% of the retail investor accounts lose money when trading CFDs. You should consider whether you can understand how CFD works and whether you can afford to take the high risk of losing your money.

FXCM

Features

- Forex Capital Markets or FXCM is one of the most popular UK based forex brokers. FXCM is owned by Jefferies Financial Group and is regulated by the Financial Conduct Authority (FCA) in the UK. FXCM is regulated in three tier-1 jurisdictions, making it a low-risk CFD and ECN broker. This broker is listed on the New York stock exchange, and its proprietary trading platforms can be used on Metatrader 4, Zulu trade, and Ninjatrader. Clients have the advantage of mobile trading, one-click order execution, and trading from real-time charts.

- FXCM offers a range of funding options so you can deposit quickly and securely.

- FXCM provides market insights, Copy trading, and has a wide range of tools like FXCM plus, live trading signals, and online market scanners.

- FXCM provides CFD trading accounts, spread betting for retail and professional accounts, and different types of trading instruments in Indices, Forex, cryptocurrencies, commodities, and several more. The client is provided with an active trader account with elite pricing combined with dedicated customer support.

- FXCM has four types of trading accounts such as the CFD trading account, Active trader that has features similar to a VIP account, spread betting, and professional clients account. There’s also a demo account for users to practice and familiarise themselves with trading.

- FXCM has a mobile trading app for both iOS and Android users. By providing this facility, users can trade on the go without missing out on possible trades. They can trade with several asset classes from the account directly, view real-time prices, price alerts, and access different order types.

- FXCM users can also use the One-click trading feature on its FX Trading Station II. Clients can place a market order with one click of the mouse, making it easier to trade quickly in times of volatility, the firm says.

- The customer support offered by FXCM is 24×5 in Arabic, Chinese, English, French, German, Greek, Italian, Japanese Korean, Spanish, and Thai., and they can be reached through email, telephone, and live chat. Customer support agents can be contacted if the client has any problems or queries. FXCM has an SMS service, and the users can directly access the trading desk during the market trading hours.

- The users can benefit from FXCM’s plethora of education and research tools; some of them include a market scanner, economic calendar, and daily market analysis. It also provides extensive market analysis daily in both webinars and written formats. The new section is updated several times a day, which offers analysis and insights for several Forex pairs like EUR, USD around the trading markets.

- 74.74% of retail investor accounts lose money when trading CFDs with FXCM

Regulation

One of the major factors to check if the broker is safe or not is to check whether they are regulated. We have reviewed the FXCM website and found that FXCM is regulated by FCA, and it is also regulated and authorized by ASIC in Australia, FSP in South Africa, ACPR in France. FXCM is authorized and regulated by several regulatory authorities under seven different jurisdictions. FXCM complies with strict capital requirements and financial standards. The clients’ funds are segregated and kept in separate accounts, and this protects the trader’s money in case if the company goes insolvent.

Awards

- Shares Awards 2020 given for Best Trading tools and research

- Compare Forex Brokers 2020 given for the Best online trading app

- Global Forex Awards 2020 given for Best Forex Trading Platform – Global

- Personal Wealth 2020 given for Best trading tools

- Forex Magnates 2012 given for best Proprietary FX platform

- Inc.500 given for list of America’s fastest-growing companies –four-time Honoree and the list goes on.

XM Vs FXCM- Features

In the table given below, we have compared some features of FXCM and XM Group so that you can have an idea about which broker suits you the best.

| Broker | XM | FXCM |

| Founded in | 2009 | 1999 |

| Headquarters | Cyprus | New York |

| Cysec Regulated | Yes | No |

| FCA Regulated | Yes | Yes |

| ASIC Regulated | Yes | Yes |

| Minimum Deposit | $5 | $50 |

| Minimum Trade | 0.01 Lots | 0.01 Lots |

| Commission | No | Yes |

| Withdrawal Fees | No | Yes |

| Deposit fees | No | No |

| Demo trading account | Yes | Yes |

| Islamic Trading Account | Yes | Yes |

| Deposit Bonus | No | No |

| Currency pairs | 57 | 39 |

| CFDs | Yes | Yes |

| Fixed Spreads | No | No |

| Variable spreads | Yes | Yes |

| Mobile App | Yes | Yes |

| Cryptocurrencies | Yes | No |

| Stocks | No | No |

| Indices | Yes | Yes |

| Energies | Yes | Yes |

| Metals | Yes | Yes |

| IOS | Yes | Yes |

| Android | Yes | Yes |

| Web platform | Yes | Yes |

| Social Trading | No | Yes |

| Metatrader 4 | Yes | Yes |

| Metatrader 5 | Yes | Yes |

| PayPal | No | No |

| Expert Advisor | Yes | Yes |

| Credit card | Yes | Yes |

| Neteller | Yes | Yes |

| Skrill | Yes | Yes |

| Hedging and Scalping | Yes | Yes |

| Negative balance protection | Yes | Yes |

A bit of Investment advice – users should never invest if they cannot afford to lose money when trading.

XM Vs FXCM- Pros and Cons

Pros

| XM | FXCM |

| Provides great educational tools | Offers excellent research tools |

| Account opening process is fast | Educational content is of the highest quality |

| CFDs and Withdrawal fees are low | Simple and easy account opening |

| Offers cryptocurrency trading | Provides easy to use interface |

Cons

| XM | FXCM |

| Forex fees are average | Does not provide cryptocurrency trading |

| Does not offer a large product portfolio | FXCM offers a limited portfolio to its users |

| Payment options are limited | High withdrawal fees for bank transfers |

| No US clients | It does not offer two-step authentication |

Trading Account Types- XM Vs FXCM

| Account Types | XM | FXCM |

| Demo account | Yes | Yes |

| VIP account | Yes | Yes |

| Micro account | Yes | No |

| Standard account | Yes | Yes |

| Zero spread account | Yes | No |

| Islamic account | Yes | Yes |

Fees Compared XM Vs FXCM

| Fees | XM | FXCM |

| Deposit fee | No | No |

| Withdrawal fee | No | Varies |

| Minimum deposit | $5 | $1 |

| Inactivity fee | Yes | No |

| Commission | No | No |

Are the brokers publicly listed?

Those companies that are publicly listed on the stock exchange are considered more regulated, and they are required to disclose their financials and their operations to the public. FXCM is a publicly listed company on the stock exchange, while XM is a privately owned company.

XM Vs FXCM- Comparison of Services

FXCM provides social trading, i.e., permits users to follow others’ trading activities, copy trading, and engage in a live discussion. If you are looking to trade forex, both XM and FXCM offer several currency pairs like EUR, USD for their clients. They also allow their users to trade commodities like silver, gold, and crude oil.

XM Vs FXCM- Comparison of Trading Features

- Both forex trading brokers allow users to hedge and to scalp. Traders can trade with expert advisors(EAs) on both FXCM and XM groups. Neither broker offers a VIP account service.

- Regarding the risk management tools, the FXCM broker does not offer negative balance protection, while the XM group provides negative protection. This prevents the traders from owing the broker more than the money that is deposited.

- FXCM has limit orders, trailing stop-loss, and price alerts to help the traders in several aspects of developing their trading strategy. A trailing stop is a form of stop-loss order in which the stop loss order itself moves in concert with the current market price. The most common order type is the market order, which is usually the best option when a trader needs to enter and exit a trade on the fly.

Our Recommendations: XM or FXCM

- FXCM website caters to both new and advanced forex traders who are looking for easy ways to open a trading account and quick deposit and withdrawal options. Moreover, it offers competitive spreads, pricing, trading platform, tools, and trading instruments suited to the needs of different traders. FXCM is transparent in its operations and constantly updates technology to help new traders.

- XM Group is preferred by CFD and Forex traders who would like to trade forex with the latest MetaTrader platform. It provides comprehensive services to users with different skill sets. If you are just a beginner and learning to trade, or if you are an advanced trader looking for an efficient and reliable trading platform, XM Group is the best bet; this trading station is simple to navigate and easy to use.

Final Thoughts – Is it XM or FXCM?

Both brokers are well regulated and provide demo accounts and excellent customer care for their users. XM Group has a wide range of instruments, and it offers the lowest prices on popular forex instruments like EUR/USD. If you are a trader looking for an established broker for trading, then FXCM is an excellent choice.

Risk Warning

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Around 74% to 89% of the retail investor accounts lose money when trading CFDs. You should consider whether you can understand how CFD works and whether you can afford to take the high risk of losing your money.