The Top 10 Forex Brokers in the United Kingdom

Forex trading in the United Kingdom is quite popular among residents, and is Financial Conduct Authority (FCA) regulated. FCA is a reputable independent body, established in 2012, that oversees the financial market and compliance in the UK. The United Kingdom, primarily London, is the biggest geographic trading center in the world accounting for around 43.1% of the total foreign exchange market. The UK financial sector houses some of the best benefits and pioneering regulator frameworks that have placed it as the world’s financial capital.

Owing to London’s dominance in the forex market, the quoted price of a currency pair is habitually the London market price. Pence is usually favored over pounds to quote prices (e.g., a GBX quoted price of 1,350 is equivalent to £13.50). Currently, there are 2,600 firms from across 60 countries listed on London Stock Exchange (LSE).

For Forex Traders: The British Pound

Before learning about the UK forex market and forex brokers, it is advisable for FX traders to know about the economy behind the pound. The GBP is the fourth-most traded currency (turnover rate) and third-most widely held reserve currency worldwide. All the major currencies in the FX market are backed up by central banks. The pound has the Bank of England, which follows a 2% inflation target policy, behind it.

The UK forex brokers City Index, FXTM, IG broker & other trading brokers incorporate a wider range of economic data into their foreign exchange decisions. The major economic data include trade balances, inflation, GDP figures, industrial production, and retail sales. These are released at regular intervals and many FX brokers make the same freely available.

Traders/investors should watch out for information on new government policies, interest rates, and unemployment rates, anything that could have a considerable impact on the exchange rates resulting in the high risk of losing money.

The pound is also one of the few currencies that is valued more than the USD, and the UK is one of the major destinations for raising capital. As a solid alternative to the USD, the pound is poised to remain a preeminent global currency for quite some time.

Forex Trading in the United Kingdom

When trading in the UK, traders should know the different options that are available with their preferred UK forex broker. Apart from the standard trading options such as stock trading, live FX trading, live CFD trading and spread betting, given below are the other trading account types available in the UK. Always check and exercise caution before investing.

Crypto Trading

~ Relatively new in the UK.

~ Since cryptos are decentralized assets, factors such as political instability and changes in interest rates pose no high risk to them the same way they affect the currency markets.

~ The growing younger population in the UK with rising income levels and extensive online technology adaptation has paved way for the increase in the crypto trading volume.

~ As of 2019, Bitcoins worth $65 billion XTB/USD is traded daily in the UK.

Commodity Trading

~ In the UK, commodity trading comprises trade in energies, precious metals, and agri commodities.

~ Since 2002, certain commodities like metals have experienced exponential growth in the country.

~ The vast demands for many raw materials and basic commodities in rising economies such as China and India means that countries like the UK can take advantage of the same.

Islamic Accounts

~ UK brokers support Islamic or swap-free accounts and comply with the Sharia law, and offer accounts best suited for Islamic traders.

~ UK Islamic investments are free from rollover interest on overnight positions.

Which FX Broker is the Best for Forex?

There are so many best trading platforms but to choose the right one gets difficult at times. Striving to find the one best forex broker that perfectly matches a trader’s style and goals is neither easy nor difficult. In the forex market, the supply of broker offerings is abundant and versatile, so the search for the best forex broker may be slightly time-consuming and laborious. The same holds true for forex UK brokers as well. When choosing FCA-regulated forex brokers, look into factors such as the trading platforms and the markets available, quality of execution software, and stability of finance (competitiveness of spreads). The table given below includes, but not limited to, the 10 best forex brokers in the United Kingdom.

Also check out the other top-rated forex brokers in the UK such as LCG (London Capital Group), Oanda, Forex.com, Alpari, Interactive Brokers UK, ActivTrades, HY Markets, HYCM, and Swissquote to name a few.

The Best Forex Brokers for Beginners

The UK FX trading market caters to beginners and pros alike. UK FX brokers strive their best to unlock the potential of foreign exchange in newbies. Some of the best FX trading platforms for beginners include:

Also, Plus500 UK is also recommended for beginners to focus on the important currency pairs that are liquid because the liquid forex pairs, in general, come with a lower bid-ask spread And, also, they float most of the time and are not monitored by the central banks. The top five FX denominations include USD pairs, EUR pairs, GBP pairs, JPY pairs, and CHF pairs. Others include AUD, CAD, MXN, CNY, and SGD.

Is Forex Trading Legitimate?

Yes, FX trading is legit. Its market cap averages $5.1 trillion per day. To verify if an FX broker is regulated in the UK, check out the FCA official website and look under the FCA register. There, look for the broker’s company name (usually different from the broker’s name). The company name can be found at the foot of the broker homepage.

Forex trading is taxable in the United Kingdom. Those earning below the salary cap of £12,500 are not required to pay any tax, but for amounts, up to £50,000 a 10% capital gains tax (CGT) and for amounts over £50,000 a 20% CGT are levied.

What is a Broker for Forex?

A retail forex broker in today’s commercial trading performs the role of an intermediary that buys and sells funds for a commission. In simple terms, a broker for forex is a kind of a third-party salesman of financial assets. A forex broker’s role is commonly associated with commodities, insurance, equities, derivatives, and even real estate.

Before the World Wide Web, FX brokers operated via phone. Clients phone in their trade orders that are bought and sold by brokers on behalf of the investor accounts for a percentage-based fee. Following the arrival of the Internet, forex brokers allow their clients to trade through digital platforms and apps.

In addition to aiding clients’ trade assets, FX brokers offer various other related auxiliary services such as asset price charting, professionally managed investments, trade programs and advice for trainers, and news feeds and information and research services. Some of these services are offered free, while others are charged depending on the broker.

Do You Need a Forex Broker?

Forex simply means currency exchange. So, technically it can be carried out without a broker; however, it involves a high risk of losing funds and entails both advantages and disadvantages. In trade, accounts lose money in different ways; to decode complex instruments and come with a success formula is no walk in the park.

| Forex Trading: With a Broker vs. Without Broker | ||

| Advantages (Without Broker) | Advantages (With Broker) | Disadvantages (Without Broker) |

|

|

|

Forex brokers do charge different levels of fee from the traders’ profits but their services are absolutely valuable and work for the investors’ benefits. Consider whether you can afford a broker or can take the high risk on your own before deciding on what suits you the best.

Forex UK Trading? What to Check for in a UK forex broker

Financial markets in the UK are mature, trustworthy, professional, highly regulated, lenient, and supportive. However, when hunting for the best forex trading platform there are certain pointers to note pertaining to what is permitted and not with regard to the regulation. Keep the following checklist in mind:

- Always choose the one that is FCA-regulated

- Look out for the minimum trade size associated with the broker. In most cases, with a 30:1 leverage a £33 minimum amount is required to open a trade position on a micro lot. However, there are brokers that offer exchanges with low deposits, even as low as £10. Find a broker that matches the need and whether you can afford the same.

- Reasonable-sized with a history of minimum 2 years

- Withdrawals and deposits processed within 2 to 3 days

- International presence including training and seminar presentations

- Easy to use trading platforms

- Complete access to trade products

- Live to stream of market prices

- Availability of risk management

- Instant execution of a trade

- High-quality and interactive financial charts

- Ability to social trade

- Timely online support

Traders are not subject to any trade restrictions when it comes to choosing their choice of forex brokers. You just have to consider whether you are ready to take the high risk of losing your money and can pick any broker provided they follow all the norms that govern the international anti-money laundering protocols. Also, it is at the discretion of the UK forex brokers to service any retail investor accounts across the world.

As a forex traders, people have more opportunities to protect their investments from the high risk of losing via a forex broker located in the United Kingdom, rather than with any other popular forex destinations in the world.

What is so Good About UK Forex Brokers?

Some of the pros of UK FX brokers are:

- They are many in number. Their number is the largest alongside Cyprus-based forex traders across the entire FX world.

- Customer support services are mostly 24/7 and offered in multiple languages.

- Offer a wide array of forex bonuses because UK FX brokers have the largest bonus systems.

- They can afford to take the responsibility for introducing the forex world to beginners, an extra service.

Trade Categories in the UK

When opening a forex account, an investor’s FX trade profits are analyzed and categorized under three main categories in the country.

Private Investor: Earnings and losses get taxed as per the capital gains imposed

Independent trader: Self-employed traders who are liable to pay biz taxes

Speculative: In the United Kingdom, forex, CFDs, and spread betting fall under the risk category because of zero underlying owned assets, and therefore, dodge tax and capital gains. The UK tax laws on FX trade are relatively more flexible than in other countries, and currently spread betting profits are not taxed.

A Guide to FX Trade in the UK

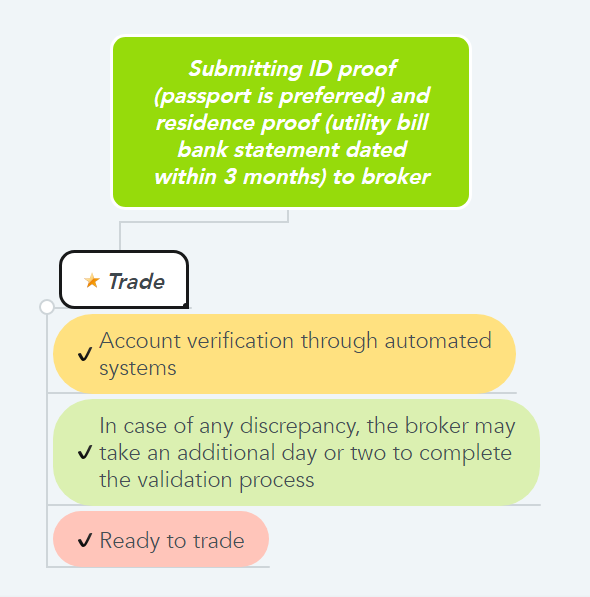

UK forex trading is pretty much the same as in the rest of the world. Typically, all the best forex brokers require the following from a trader to get started:

Forex Trading Challenges in the UK

In terms of challenges, even minor changes in the American economy may impact the UK market as the United States and the United Kingdom hold huge trade partnerships and their economies are intertwined. Likewise, the EU too affects the UK trade market considerably as the latter is a multi-nation trade bloc. Well, even since the Brexit negotiations began in 2017, the effect on the UK FX market has oscillated between favorable and unfavorable.

Reasons Why Trade Accounts Lose Money

Some of the common reasons as to why accounts lose money include:

- Trying to beat the market instead of understanding it

- Staring with too-small capital amount

- Poor risk management

- Indecisive trading

- Not trading with the trend, i.e., either picking tops or bottoms

- Giving into too much greed

- Buying worthless trade systems

UK Forex Blogs

Traders can also reach out to and connect with forex influencers through blogs in the niche market. This is especially good for newbies as they can gain a basic understanding of the FX market before they can afford to take the first big step of investing. To generate more traffic, leads, and sales, and to avoid losing money rapidly checkout some of the best forex blogs given below.

Tickmill: Best forex brokers; they share their trading knowledge, provide significant market observations, and offer updates on any upcoming important economic events according to Tickmill review.

Better Trader: Learn how to trade forex, gold, FTSE 100, stocks, crude oil, and S&P 500 and pick the best forex trader platform from industry experts. Other pros include options trades and binary bets recommendations.

Cyber Mentors: Provides detailed information on forex, auto trade, and investigative insights on various binary options trading bots.

Trading College: Offers both classroom and online trading courses by professional traders, and provides free resources, and expert trading opinions, and mentorships. Get detailed information on stocks, commodities, and FX trade.

Smart Forex: One of the best web resources for learning how to avoid losing your money and be profitable in FX trading, improve intraday forex strategies, and automate FX trading systems.

Forex Trading: Learn about highly profitable trade techniques through online seminars and personal coaching and mentorship programs for both beginners and advanced traders.

DailyFX: One of the leading portals for trade news, indicators, charts, and analysis, i.e., every tool needed for trading in the FX market.

Also check out other forex blogs such as Yadix, BluFX, ForexMinute, ForexBuuzz, SB Forex, and FXPro.

UK FX Market and Brokers Are Cause of World Envy

The UK’s forex market is the spine of global trade and investing. According to the survey conducted by the Bank of International Settlements, forex trading platforms have grown by 30% in London in the last three years since the Brexit referendum. England’s capital is the global hub of foreign exchange with a 43% market share.

The UK’s competitive advantage in forex is a vital part of the financial services sector that makes up for 10% of the country’s total economic output and employs around 2 million people. This industry pays, exports, and generates a surplus of trade than any other.

Final Verdict

The UK is constantly ranked as one of the top 5 global economies attracting retail investor accounts worldwide to trade stocks, forex, cryptos, commodities, and CFDs. On that note, certain challenges in the forex market are inherent, i.e., accounts lose money at times, and the UK FX market is no exception. However, the overall financial scenario is quite favorable and looking solid in the UK. Apart from these top UK brokers, you can also explore other top brokers from all around the world on our top brokers’ list.

UK forex brokers like the eToro app, Markets.com & others are reputed for their support and for being fair when dealing with clients. This goes a big way in reducing the chances of losing money rapidly. When trading with one, always remember to check that the forex broker is FCA-monitored and an LTD company that offers a state-of-art trading platform, and any transactions are conducted via safe channels.

Globally, the UK financial market sector trades around $5.1 trillion in volume daily. This is humongous when compared with the other financial markets. Advances in better Internet coverage and online technology and increased competition among forex brokers have made currency exchange feasible and more accessible in the United Kingdom.