US Dollar Index (DXY) Loses the Traction; Dips Below 100

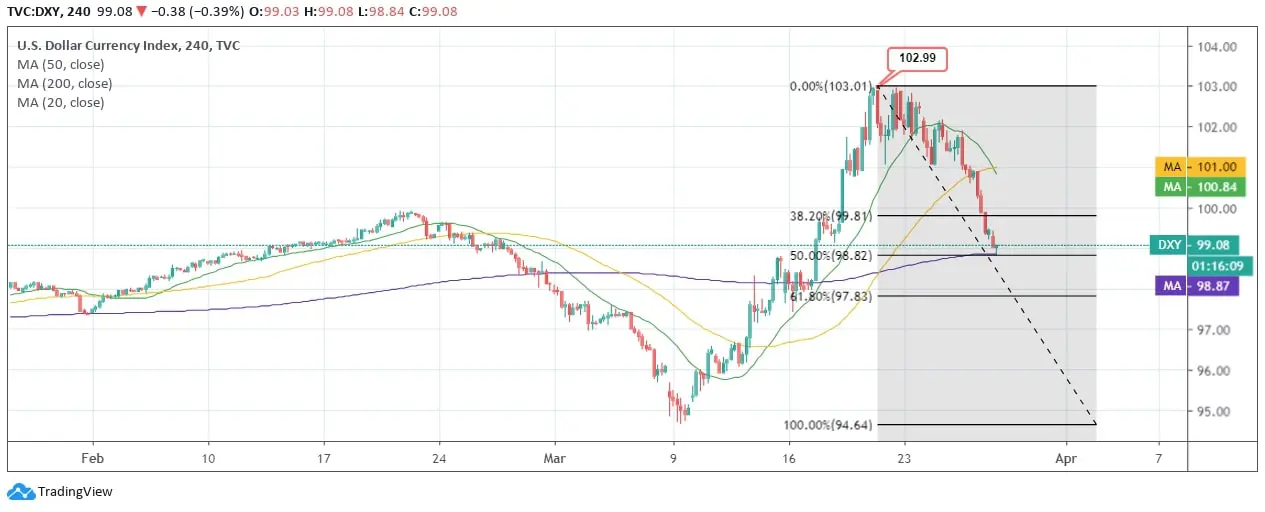

US Dollar Index (DXY) continues to recede as the trend falls below 38.20% Fib Retracement level. The index nosedives below 50-day and 20-day MA. DXY slid below 100 in yesterday’s session as the American Dollar extended its fall against the major currencies of the basket.

US Dollar Index nosedives below 100 after 10 days hen it last happened on March 17, 2020, but impressively held a bullish momentum as it rose to 102.99 after 3 years of a downside break. However, the current fall is the result of an increasing number of Coronavirus cases in the US, which has exceeded the toll of a total number of cases in China—the epicenter of the Pandemic. The buyers are left disappointed as the index loses traction and support of 20-day MA. This is likely to lure an increasing number of short positions, and on the contrary, an upside break above 100 and 101 will regain the lost short and medium-term support.

The major resistance happens to be the previous day’s high at 101.02, which will lead to a cross above daily 61.8% Fib Retracement at 100.

As the wide-spreading deadly virus is not ready to leave any sooner, Dollar is the safest haven considering the assumptions about the liquidity crunch amidst the ongoing recession and financial crisis. This has led to major sell-off and is thereby likely to increase the demand of the American Dollar, which will lead to a rebound of the Index soon.